-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

So when the hell are housing prices gonna come back down and how much will interest soar???

- Thread starter Turbowaffles

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Interesting. Seems like it's somewhat cooling off?

We're in Toronto, looking to move to a quieter neighbourhood with bigger lots. I've been very surprised by how many homeowners have let their houses fall apart. Many appear to have not had anyone living in them for years. Everything we've seen so far in the CAD$3-4million range has been in teardown condition. Some appear to be hazardous/toxic. I don't think it's unreasonable to expect a house to be livable for that kind of money. Possibly another sign of an unhealthy market.

Get Pre-Approved for a mortgage, this is pretty easy. I wouldn't use what you're approved for as a realistic number to budget on, they'll always approve you for a high numberI need to figure out my living situation but I don't even know where to start. I could put together like $100k or more (depends on how much I want in savings) for a down payment but I don't even know how to start the process so I can be in a position to actually buy something.

Find a Realtor that you trust, word of mouth is best. They'll guide you through everything.

Seems to be same across Europe too.

Here in Ireland, prices are at near record level as demand is through the roof and construction has been restricted due to COVID in last year.

I've bought a house and sold my apartment.

COVID really focused the mind on how small the apartment was, if you spend 24hrs a day in rather than just few hours at evening & sleeping.

Lots of others moving for more bedrooms, home office setup or bigger garden for shed, office hybrid.

Here in Ireland, prices are at near record level as demand is through the roof and construction has been restricted due to COVID in last year.

I've bought a house and sold my apartment.

COVID really focused the mind on how small the apartment was, if you spend 24hrs a day in rather than just few hours at evening & sleeping.

Lots of others moving for more bedrooms, home office setup or bigger garden for shed, office hybrid.

It's a damn shame I hate living in RI. I was worried about being trapped here, but with the Northeast housing market skyrocketing... Looks like I am stuck for the foreseeable future in a comfortable, boring place. I shouldn't complain, and yet here I am.

Tokyo.

3D printing is irrelevant. Need legal ability to construct homes, the problem is not technological it is strictly government interferance in the market. In Tokyo it is 100% legal to demolish a old home to built new ones (plural) it is even highly encourages by the fact that all inherritance is taxed with a death tax.

That's incredible. The idea we need to keep old buildings around is the dumbest thing. Good on Tokyo.

:)

My wife and I invest in real estate and this market is insane and I don't see it improving. There's a few things at play here. Home inventory is at ridiculously low levels prompting tons of competition for homes. We refuse to buy a property unseen but many investors with more bucks than us are putting in blind bids at over the asking price. Another thing is there are not a lot of people that are overleveraged like in 2009 so not looking at a glut of houses being foreclosed on. In addition government programs that are extending mortgages out for 40 years for those in deferment are also making sure people don't lose their homes. They really do need to build more inventory but they are getting bought up like mad.

Not in my lifetime, that's for sure.

My mum bought her 1st house in 1988 for £16 000. In that same location, today a 4 bedroom house would cost about £300 000 - 400 000. A 2400% increase within 30 years. In the area I am living right now, house prices have septupled since 2000.

My mum bought her 1st house in 1988 for £16 000. In that same location, today a 4 bedroom house would cost about £300 000 - 400 000. A 2400% increase within 30 years. In the area I am living right now, house prices have septupled since 2000.

I think some older neighborhoods should be preserved. Would you raze the old North End of Boston?That's incredible. The idea we need to keep old buildings around is the dumbest thing. Good on Tokyo.

You have to remember Tokyo was basically razed by bombs and fire during WW2. They preserve some old buildings in Tokyo that survived.

"A Cultural Property (文化財, bunkazai) is administered by the Japanese government's Agency for Cultural Affairs, and includes tangible properties (structures and works of art or craft); intangible properties (performing arts and craft techniques); folk properties both tangible and intangible; monuments historic, scenic and natural; cultural landscapes; and groups of traditional buildings. Buried properties and conservation techniques are also protected.[SUP][1][/SUP] Together these cultural properties are to be preserved and utilized as the heritage of the Japanese people.[SUP][2][/SUP][SUP][note 1][/SUP]

To protect Japan's cultural heritage, the Law for the Protection of Cultural Properties contains a "designation system" (指定制度) under which selected important items are designated as Cultural Properties,[SUP][note 2][/SUP] which imposes restrictions on the alteration, repair, and export of such designated objects. Designation can occur at a national (国指定文化財), prefectural (都道府県指定文化財) or municipal (市町村指定文化財) level. As of 1 February 2012, there were approximately 16,000 nationally designated, 21,000 prefecturally designated, and 86,000 municipally designated properties (one property may include more than one item).[SUP][3][/SUP][SUP][4][/SUP] Besides the designation system there also exists a "registration system" (登録制度), which guarantees a lower level of protection and support.[SUP][2]" Wikipedia[/SUP]

As someone who will have finally saved up the 20% down for a house by the end of this year, this thought gives me anxiety about entering the housing market.

just start now. you dont need 20%. you'll just have to pay PMI for awhile until you hit that 20% (and PMI isn't much, you can ask your bank to provided you a few estimates at the same price range if you put down 10, 15, 20% etc).

I keep thinking that too, but I doubt it'll happen any time soon, especially with the current gov in place. They'll find some way to stop it and things will just keep going skywards. I've been looking recently and things are just frustrating as all hell.

My wife has struggled to sell her shared ownership flat and has ended up accepting an offer that's 50k under the property's original sale value. The leasehold property market in UK is on the precipice of a crash. Our government are doing what they've done with every other crisis of the last decade - deny there's a problem, make it worse and hope it doesn't blow up in their face. If we don't have a property price crash, it will be despite what the government did.

On the flip side of this: I inherited a house late last year from my father who had abandoned me as a kid. I wanted nothing to do with it so I had the contents donated, the interior and exterior cleaned.

I did no major work to the house, which was in my mind quite shabby. I spoke with a relator who advised me to list the house around $175,000 and said she was optimistic that it would sell in a few weeks.

Within 3 days of listing I received 32 offers. The house ended up selling for $289,000.

This housing market is fucking nuts.

On the plus side, I no longer have to saddle my kids with college loan debts. :)

I did no major work to the house, which was in my mind quite shabby. I spoke with a relator who advised me to list the house around $175,000 and said she was optimistic that it would sell in a few weeks.

Within 3 days of listing I received 32 offers. The house ended up selling for $289,000.

This housing market is fucking nuts.

On the plus side, I no longer have to saddle my kids with college loan debts. :)

just start now. you dont need 20%. you'll just have to pay PMI for awhile until you hit that 20% (and PMI isn't much, you can ask your bank to provided you a few estimates at the same price range if you put down 10, 15, 20% etc).

This. So much this.

If you want to live in the same area then you'll have to spend the 250 on an equivalent place. If you want to move to a cheaper area, then go for it.I believe so.

I was actually looking recently at my house I bought for 165k, and the Zillow value as of last week was 210. I told my wife that if it hits 250, we're selling lol

Yeah, i wish someone told me this years ago

just start now. you dont need 20%. you'll just have to pay PMI for awhile until you hit that 20% (and PMI isn't much, you can ask your bank to provided you a few estimates at the same price range if you put down 10, 15, 20% etc).

Same. Folks need to look into the FHA program. That way you're putting down 3.5%. Yes, there is a fee for this government program PMI. But you can get into a home for 3.5% Down. If you're looking at like 300k+Homes, You're just talking about shaving a fewe hundered dollars off a mortgage.

20% down on anything, if you don't have any plans on paying it off totally (the entire home) a year after you get it or something, is a hard sell. The interest rates are stupid low.

Say you want to buy a 400k house. Your mortgage looks to be around 1800 or so on a 30 year yeah?

Now, you bring in that jar. You saved it up for YEARS. The jar of 20k.

Your mortgage over 30 years is now. 1700.

Its a choice, but with homes things break all the time. Having that 20k in an account + having a low mortgage seems like a win win.

or saving up 20k + another 20k for house shit. Instead of just the 20k and losing it all for maybe a 100 and some change off a mortgage.

Same. Folks need to look into the FHA program. That way you're putting down 3.5%. Yes, there is a fee for this government program PMI. But you can get into a home for 3.5% Down. If you're looking at like 300k+Homes, You're just talking about shaving a fewe hundered dollars off a mortgage.

20% down on anything, if you don't have any plans on paying it off totally (the entire home) a year after you get it or something, is a hard sell. The interest rates are stupid low.

Say you want to buy a 400k house. Your mortgage looks to be around 1800 or so on a 30 year yeah?

Now, you bring in that jar. You saved it up for YEARS. The jar of 20k.

Your mortgage over 30 years is now. 1700.

Its a choice, but with homes things break all the time. Having that 20k in an account + having a low mortgage seems like a win win.

or saving up 20k + another 20k for house shit. Instead of just the 20k and losing it all for maybe a 100 and some change off a mortgage.

Furthermore... almost all lenders will allow for a re-amortization or "recast" of the loan if the borrower wants to apply a large amount of principal (typically $20k as a minimum) at a later date. This wouldn't affect the interest rate, and typically only requires a fee of about $250.

I'd say give it 2 or 3 years. It will turn out that a lot of people really couldn't afford bidding 30-50k over already greatly inflated listing prices and the foreclosures will start popping up and send this thing tumbling. Just give it time.

My wife has struggled to sell her shared ownership flat and has ended up accepting an offer that's 50k under the property's original sale value. The leasehold property market in UK is on the precipice of a crash. Our government are doing what they've done with every other crisis of the last decade - deny there's a problem, make it worse and hope it doesn't blow up in their face. If we don't have a property price crash, it will be despite what the government did.

I guess we're just in different areas. Around here anything worthwhile gets snapped up as soon as it's available no matter the price and then converted into HMOs (House of Multiple Occupancy) to let out to students. It's got so bad the council (begrudgingly) created a law saying you can only have a certain % of HMOs wthin a certain distance of the house you want to convert. They also ignore that law unless the locals throw a massive stink. It leaves either overpriced 1bed crates or multi million pound houses with 7 bedrooms and as many bathrooms with little in between.

The real estate lobby isn't the problem-the only reason why investors are moving into SFH as an investment vehicle is because of the perception that many communities simply cannot build more SFH detached housing stock because of the regulatory environment.

The real issue is local homeowners (traditional NIMBYs), community activist groups (BANANA- build absolutely nothing anywhere near anything) abusing review/zoning/environmental regs. These were maybe were well intentioned at one point but are now perverted to just prevent land from doing what it needs to support for the community to function.

It's take a while but states and even the federal government are noticing this regulatory capture and are moving in rules to preempt the worst of the abuse. Then we'll see more building, which is the only way that some of these markets can start to normalize.

Yup. Zoning requirements (single family only zoning), lot minimums and parking requirements have killed housing affordability as a favor to the automobile and landowner classes by forcing sprawl and keeping out new neighbors. Thankfully there's some efforts to stop this federally (through incentives to localities who promote housing development by repealing these restrictions included in the current Infrastructure Plan), but it'll take local activism to fix things.

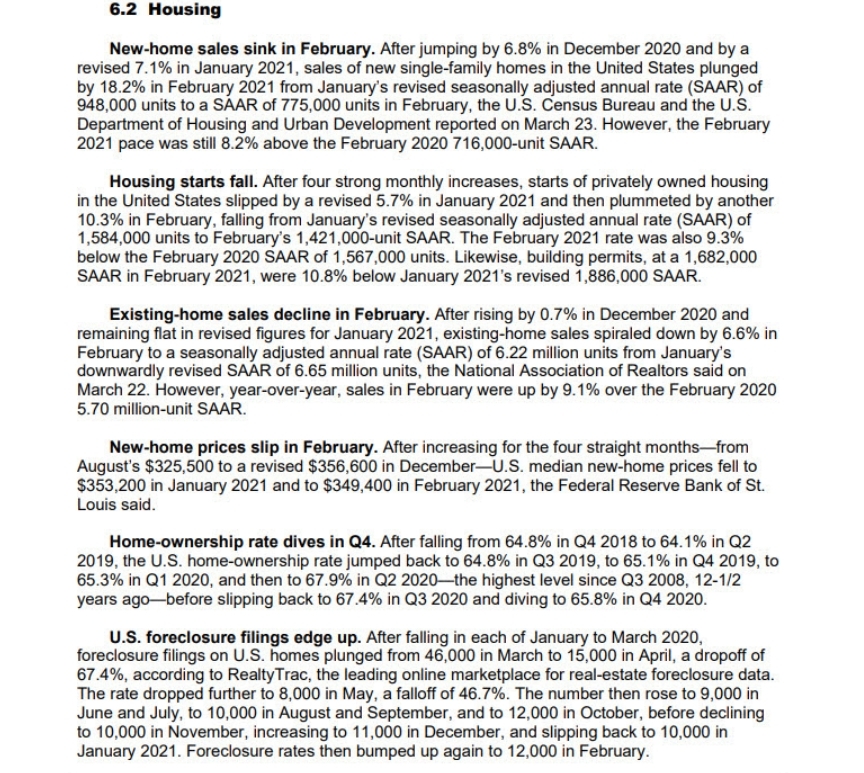

it is cooling off in the same way that an engine without oil that just threw a rod is cooling off-it's broken on the side of the road with the blinkers on.

This data points to a seizing up situation in the market, where new housing stock isn't created and existing properties aren't entering the market (people staying put). RIght now the sense from any realtor working many markets is that people are at the bar and the longer they stay looking for houses the more the beer goggle effect kicks in.

If I'm in the market for a new development or buying a lot/building a house in AZ, how screwed am I?it is cooling off in the same way that an engine without oil that just threw a rod is cooling off-it's broken on the side of the road with the blinkers on.

This data points to a seizing up situation in the market, where new housing stock isn't created and existing properties aren't entering the market (people staying put). RIght now the sense from any realtor working many markets is that people are at the bar and the longer they stay looking for houses the more the beer goggle effect kicks in.

And now in basic English?it is cooling off in the same way that an engine without oil that just threw a rod is cooling off-it's broken on the side of the road with the blinkers on.

This data points to a seizing up situation in the market, where new housing stock isn't created and existing properties aren't entering the market (people staying put). RIght now the sense from any realtor working many markets is that people are at the bar and the longer they stay looking for houses the more the beer goggle effect kicks in.

Nah, lenders are stricter than ever who they loan to. Things will stabilize a bit but there won't be a crash.I'd say give it 2 or 3 years. It will turn out that a lot of people really couldn't afford bidding 30-50k over already greatly inflated listing prices and the foreclosures will start popping up and send this thing tumbling. Just give it time.

The investors paying with cash are the interesting ones, sooner or later they're going to want a return on their investment. It won't crash then either

- fewer newly constructed houses entering the market

- the number of existing listings ("inventory") has plummeted

- without sufficient numbers of properties to choose from in a market, prices rapidly rise (this is where you get bidding wars)

- remaining buyers start to pile on in a FOMO effect, fearing if they don't get in now they'll never get in

- housing inventories hit extreme crisis levels as buyers dig deeper to not miss their chance

the result is a paralyzed market, where people that want to move can't move in their communities to more suitable housing and the people looking to buy homes are competing for a meager fraction of the volume that's needed for the market to operate in a way that doesn't induce demand.

One theory is that some of the investors are basically parking cash expecting inflation to strongly tick up next couple years. And if that happens, prices won't go down either for obvious reasons. Although if Fed is forced to up the interest rates, market may cool down.Nah, lenders are stricter than ever who they loan to. Things will stabilize a bit but there won't be a crash.

The investors paying with cash are the interesting ones, sooner or later they're going to want a return on their investment. It won't crash then either

Curtains Up for the One Percent (Published 2021)

While many Americans were stockpiling toilet paper and Clorox, the rich bought houses, sparking a gold rush in the decorating trades.

The construction costs are not really the bottleneck here, it is land. You can't 3D print land.When 3D printers get to be able to easily build houses and apartments, increasing dramatically the offer.

NIMBYism prevents the building of new stock and will be happen regardless of how cheaply you can print a house.

WFH will, unfortunately, make things worse, as remote workers relocate to the suburbs but retain their urban core salaries, but it might alleviate pressure in the urban core.

Last edited:

Yeah, people expecting prices to crash are deluding themselves. Part of the reason the 2008 crash was so insane is that housing prices had never gone down across the board, and they haven't since that happened.

At best, you can hope for slowing of the insane growth in prices.

If you have 5/10/15 percent saved up for a down payment, it's best to get into the market now at the current prices than hope for some mythical event that likely won't happen.

At best, you can hope for slowing of the insane growth in prices.

If you have 5/10/15 percent saved up for a down payment, it's best to get into the market now at the current prices than hope for some mythical event that likely won't happen.

As someone who will have finally saved up the 20% down for a house by the end of this year, this thought gives me anxiety about entering the housing market.

You should get in now. Having 15% vs 20% is not going to make a massive difference compared to how much home prices are going up. Right now on average your monthly payment on any home is going up $45.00 per month so in a year thats an increase in payment of $540. Your temporary PMI would be a fraction of that.

Yeah, people expecting prices to crash are deluding themselves. Part of the reason the 2008 crash was so insane is that housing prices had never gone down across the board, and they haven't since that happened.

At best, you can hope for slowing of the insane growth in prices.

If you have 5/10/15 percent saved up for a down payment, it's best to get into the market now at the current prices than hope for some mythical event that likely won't happen.

Yup

Check out who's at #5. I actually don't get why Vietnam isn't on this list, they are also at 90%.You do know that communist nations were notorious for housing storages. Centrally planned resulted in multiple families sharing apartments and internal control of movement.

I sort of agree with this with one caveat, this is the unlimited free market solution to housing shortages.The more free market a city is in regards to it's housing supply, the more affordable and available housing is.

/https://www.thestar.com/content/dam/thestar/news/world/2013/02/07/hong_kongs_poor_live_in_cages_cubicles_amid_wealth/hong_kong_caged.jpg)

What I'd like to see wrt regulations:

Fifty Years of Homeownership

After the Cuban revolution in 1959, evictions were halted, most rents were reduced and urban land speculation was largely controlled. Through the 1960 Urban Reform Law, tenants became homeowners by amortizing the purchase price of their units through rents. Landlords and other property holders were allowed to keep their own home as well as a second vacation home. State-built housing was offered as long-term "leaseholding," with rents set at 10 percent of family income. Private renting was prohibited. In addition, vacant units confiscated from emigrants were distributed to people in need, and the Cuban lottery was transformed into a short-lived vehicle for financing new housing.

Research and Resources (Listing) | Reimagine!

www.reimaginerpe.org

Rent-to-own amortizing and hard limits on the amount of property an individual can own, as well as a "you must reside in them" rule but these are easily gameable.

Ultimately, the core issue is not enough building, largely due to NIMBY real estate lobbying. And you can overcome this by:

1) Out building the buyers (Tokyo, Hong Kong)

2) Hard limits on home ownership and speculation and a mandate to maximize people housed (Cuba, Vietnam).

China is, curiously enough, doing both, they are both outbuilding the speculators and also just moving people around by fiat. Regardless of which path you choose, it is clear US-style NIMBY regulatory capture is the worst of both worlds.

Last edited:

Here's where I like to bring up a compound interest calculator. If your mum took that 16,000 and invested in the stock market which has been averaging 10.7% return per year for the last 30 years. So after 30 years it would be worth 337,713. You have to consider the additional cost of 30 years of property tax and maintenance as well. If a mortgage was involved, the mortgage interest rates in 1988 were ridiculously high. If somebody choses to not buy, then of course they have to live somewhere so paying rent is a factor.My mum bought her 1st house in 1988 for £16 000. In that same location, today a 4 bedroom house would cost about £300 000 - 400 000. A 2400% increase within 30 years. In the area I am living right now, house prices have septupled since 2000.

So the debate continues. Invest in real estate or invest in the stock market. The worst thing you can do is not invest at all.

Last edited:

To mirror some of the points brought up about people being "frozen": My wife and I thought about selling our house this year and moving into something bigger that could potentially be our "forever home." Yes, we would make a huge profit on our house compared to three years ago when we bought it, but that profit doesn't mean anything if we have to turn around and buy a house that has appreciated in value the same amount or more over the same time span. We're also not even sure we'd be able to secure a house in our price range at all.

At the end of the day, we feel lucky to have a house that we bought for a reasonable price and that can last us for the foreseeable future. But I'm concerned what things are going to look like in the market in a few years -- not just for us, but for everyone trying to secure a home at a reasonable price.

At the end of the day, we feel lucky to have a house that we bought for a reasonable price and that can last us for the foreseeable future. But I'm concerned what things are going to look like in the market in a few years -- not just for us, but for everyone trying to secure a home at a reasonable price.

Wasn't Oklahoma the only state in 2020 where every single county voted Trump?Want a cheap, affordable and large house in the United States? Oklahoma is waiting for you.

Here's where I like to bring up a compound interest calculator. If your mum took that 16,000 and invested in the stock market which has been averaging 10.7% return per year for the last 30 years. So after 30 years it would be worth 337,713. You have to consider the additional cost of 30 years of property tax and maintenance as well. If a mortgage was involved, the mortgage interest rates in 1988 were ridiculously high. If somebody choses to not buy, then of course they have to live somewhere so paying rent is a factor.

So the debate continues. Invest in real estate or invest in the stock market. The worst thing you can do is not invest at all.

Yeah pick your poison both are better than nothing

To mirror some of the points brought up about people being "frozen": My wife and I thought about selling our house this year and moving into something bigger that could potentially be our "forever home." Yes, we would make a huge profit on our house compared to three years ago when we bought it, but that profit doesn't mean anything if we have to turn around and buy a house that has appreciated in value the same amount or more over the same time span. We're also not even sure we'd be able to secure a house in our price range at all.

At the end of the day, we feel lucky to have a house that we bought for a reasonable price and that can last us for the foreseeable future. But I'm concerned what things are going to look like in the market in a few years -- not just for us, but for everyone trying to secure a home at a reasonable price.

Looking is free, there's no harm in browsing listings to see what's available and for how much.

What? Where?f your are in a democratic state/city combo, prices will never go down because they make constructing new homes illegal.

oklahoma:Want a cheap, affordable and large house in the United States? Oklahoma is waiting for you.

Every time I see one of these threads, I can't help but feel extremely lucky. Started looking for houses in DC late last year. Saw one listed that we liked within 3 weeks and went to see it a couple days later (that was Saturday), put an offer on it $5k over asking on it the next day (Sunday) with a contingency that offer would be invalid if they didn't accept within 24-ish hours or so, offer was accepted by the end of the next day (Monday). Got a $5k credit after inspection too so basically got it at asking price which we already thought was a bit cheap for what it was and the location. Extremely painless other than all the paperwork and some back and forth getting that credit. Meanwhile everyone else I know looking for places have been doing so for months if not years and have put offers on multiple places only to get outbid by cash bidders or whatever. Still waiting for the other shoe to drop on this place and find out that it was built on the Hellmouth or something.

Seattle, SF, Portland, NYC, LA, Austin, you name it.

Your traditional anti-development NIMBYs join forces with BANANA (build absolutely nothing anywhere near anything) types who mask their NIBMY agenda with progressive aesthetics. They completement each other in blue cities, capturing city councils and policymakers, and prevent any land use change whatsoever.

Under skilled regulators and urban planners have no chance to navigate through the political hurdles to help reform things. In many states these regulators have capitulated on reform and are directly appealing (allying with construction and developer interests) to state legislatures to intervene.

I see plenty of new places going up here in Portland, is it easy to do? Probably not, but I am not sure building new is illegal.Seattle, SF, Portland, NYC, LA, Austin, you name it.

Your traditional anti-development NIMBYs join forces with BANANA (build absolutely nothing anywhere near anything) types who mask their NIBMY agenda with progressive aesthetics. They completement each other in blue cities, capturing city councils and policymakers, and prevent any land use change whatsoever.

Under skilled regulators and urban planners have no chance to navigate through the political hurdles to help reform things. In many states these regulators have capitulated on reform and are directly appealing (allying with construction and developer interests) to state legislatures to intervene.

Im in the middle of refinancing my condo to drop my interest from 4.25% to 3% 20 year in the hopes of it making my monthly payment smaller cause the bank is offering only 250 closing costs. Sounds good to me but it has been a pain in the ass process. Am i wise here?

Seattle, SF, Portland, NYC, LA, Austin, you name it.

Your traditional anti-development NIMBYs join forces with BANANA (build absolutely nothing anywhere near anything) types who mask their NIBMY agenda with progressive aesthetics. They completement each other in blue cities, capturing city councils and policymakers, and prevent any land use change whatsoever.

Under skilled regulators and urban planners have no chance to navigate through the political hurdles to help reform things. In many states these regulators have capitulated on reform and are directly appealing (allying with construction and developer interests) to state legislatures to intervene.

In Oregon the state recently passed a bunch of reforms for housing. Such as requiring duplexes, triplexes, townhouses, etc. mixed with regular single family homes. Unless local/city find ways around the laws all new residential zoning in Oregon requires mixed housing.

The laws led to some pretty sensationalized headlines such as "Oregon bans single family housing".

Will give it a watch, thanks.

Yup.In Oregon the state recently passed a bunch of reforms for housing. Such as requiring duplexes, triplexes, townhouses, etc. mixed with regular single family homes. Unless local/city find ways around the laws all new residential zoning in Oregon requires mixed housing.

The laws led to some pretty sensationalized headlines such as "Oregon bans single family housing".

:quality(70)/s3.amazonaws.com/arc-wordpress-client-uploads/wweek/wp-content/uploads/2019/09/10155006/WesleyLapointe_IMG_8523.jpg)

Portland Will Allow Four Homes on Nearly Any Residential Property in the City

City Hall has, at long last, overhauled its residential neighborhood zoning.

i know this is some what in jest, but i lived in OK for a couple years and i really didn't mind it.Want a cheap, affordable and large house in the United States? Oklahoma is waiting for you.

Yeah, this seems kind of a no brainer. Usually if you are around 0.5% or higher, its worth it.Im in the middle of refinancing my condo to drop my interest from 4.25% to 3% 20 year in the hopes of it making my monthly payment smaller cause the bank is offering only 250 closing costs. Sounds good to me but it has been a pain in the ass process. Am i wise here?

Oklahoma - "I really didn't mind living there" state. ;)i know this is some what in jest, but i lived in OK for a couple years and i really didn't mind it.