Yeah that hurts. Have some long dated calls for awhile now. They're gonna take a big hit.

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Stock Market Era |OT3| Nobody expects the Spanish Inflation!

- Thread starter Sheepinator

- Start date

- OT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I wasn't being aggressive to you. Sorry if it came across that way. I was just stating that what AMC said was no shit, as in no kidding and stating the obvious. It was a response to the AMC article, not you.ok I don't get why you are being aggressive at me I was literally just answering some other person's question

Here comes Elon manipulating crypto again. Just not sure if this is a pump or dump.

This man is fking weird 😂😂

Fuck off Elon.

Anyway, looking at the TSLA chart. There's a few bearish things going on. It's recently broken trendlines going back to last August and March 2020. The 21ema is below the 50ma, and it's in a bearish descending triangle from the January peak, with the base at $540 which has been a critical level multiple times so far. If it gets there, I think we'll either see support and with that a bounce to low $600's, or if it fails, then a drop to $465 if the round number $500 fails.

Anyway, looking at the TSLA chart. There's a few bearish things going on. It's recently broken trendlines going back to last August and March 2020. The 21ema is below the 50ma, and it's in a bearish descending triangle from the January peak, with the base at $540 which has been a critical level multiple times so far. If it gets there, I think we'll either see support and with that a bounce to low $600's, or if it fails, then a drop to $465 if the round number $500 fails.

AMC is seeking shareholder approval for yet more dilution. This time they want approval for 25M more shares in 2022.

They've had a slew of bad news lately:

-Orders in China down nearly 50% in May compared to April.

-Bad PR in China from consumers and state media over braking and auto pilot issues. Several high profile fatal accidents. Losing favor of the CCP is a big deal.

-Recalls of certain Model 3 and Model Y vehicles in US over loose brake caliper bolts.

-Recalls of certain Model 3 and Model Y vehicles in US over seat belt issues.

-Potential delay of production at German factory

-Tesla finally admitting to impact of chip shortages. Raised prices and removed features, including radar sensors and lumbar support adjustors.

The stock is holding up quite well considering. I think it still has a ways down left to go. Stock is around where they were on March 5th 2021 and before that, November 24th 2020.

And Tesla proceeds to produce record number of cars and sell all of them ¯\_(ツ)_/¯

Anyway hasn't Giga Berlin been "delayed" like 10 times now? So far few of those rumours have panned out. I suspect that the estimated schedule of Giga Berlin has so much air in it that there is some room for a few minor delays without affecting the bigger schedule.

Last edited:

I wasn't being aggressive to you. Sorry if it came across that way. I was just stating that what AMC said was no shit, as in no kidding and stating the obvious. It was a response to the AMC article, not you.

lol all good. These meme stock things get so emotional with this shit sometimes it's hard to tell.

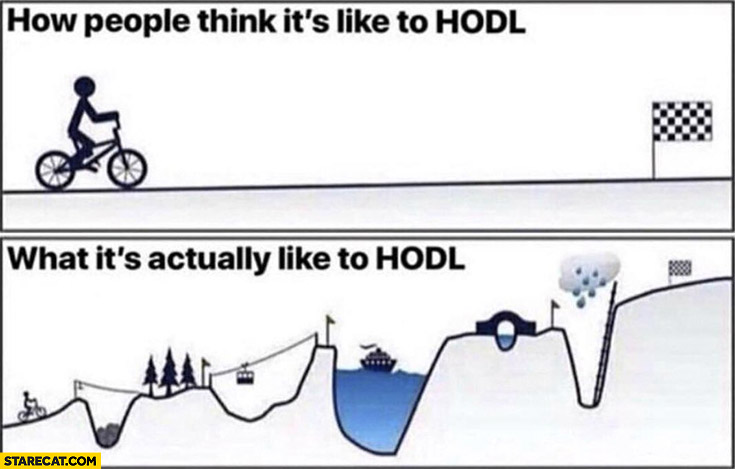

I wonder what part of this journey the current runup of NOK represents 🤔

Fuck off Elon.

Anyway, looking at the TSLA chart. There's a few bearish things going on. It's recently broken trendlines going back to last August and March 2020. The 21ema is below the 50ma, and it's in a bearish descending triangle from the January peak, with the base at $540 which has been a critical level multiple times so far. If it gets there, I think we'll either see support and with that a bounce to low $600's, or if it fails, then a drop to $465 if the round number $500 fails.

Yeah, the TSLA chart today isn't looking so positive to me either. And I say that as a very long term TSLA holder who has no intentions of selling for many years.

Tesla the company is doing great right now, they are breaking records with every quarter and accelerating growth on all fronts, with many huge catalysts coming in the next year or two.

However the Fear, Uncertainty, and Doubt war against them has ramped up to unprecedented levels, and it's allowing the money makers to manipulate the stock price at will due to relatively low volume. As long as it stays this way I feel the MM's will keep TSLA down and maybe even crash it further to shake the loose shares off the trees so to speak. We could see it go below $500 before it pops upwards again.

That said, in time TSLA is still going to the moon. There will come a point where the fundamentals launch the stock upwards to new plateaus due to how profitable they have become, it's a certainty this happens but WHEN it happens is very much up in the air right now.

So this deal is wild. 10% of UMG for $3.5b. They get to keep $1.5b and stay PSTH to go after another company.

wild good or bad?So this deal is wild. 10% of UMG for $3.5b. They get to keep $1.5b and stay PSTH to go after another company.

Looks to be rewarding long term. Options are fucked and the market doesn't seem to like it.

Cheers, that's what I thought, I couldn't see why the market didn't like it but who knows these days??Looks to be rewarding long term. Options are fucked and the market doesn't seem to like it.

That's why we need a Nancy Pelosi's ETF (and the reason keeping me bullish on TSLA atm)Woah Roblox almost to 100. It fell off my radar with all the other craziness going on.

What's a good long term REIT to look at ATM? Need to find some long term holds to roll amc earnings into.

I'm in a REIT fund. Haven't got a clue about them individually.What's a good long term REIT to look at ATM? Need to find some long term holds to roll amc earnings into.

Yeah like i have VNQ in my watch list, seems like a safe general one? But looking into them for the first time, there's ones that specialize in like cannabis facilities like IIPR, ones centered on retirement homes or data centers and such, idk if it's worth looking into a more specialized one like that or if it's significantly riskier than just something real wide like VNQ. But it's a totally new to me sector i'd like to add to my portfolio so just curious if anyone has recommendations, since some of these seem to move very flat aside from the drop and recovery last year.

O looks intriguing

O looks intriguing

Last edited:

Never to the moon gains, but I always liked REITs for the really good dividends, but they're hard to figure out sometimes. Shopping malls were supposed to be dead, but SPG is doing just fine. Now it's recommended that REITs holding commercial and office buildings should be avoided because of the work from home trend. That makes sense.What's a good long term REIT to look at ATM? Need to find some long term holds to roll amc earnings into.

Residential holdings always seem like a good REIT. Any REIT that holds residential in a major city sounds good to me.

How do you guys start off investing? I am slowly throwing money into my brokerage account. So far I threw in like $200. Should I go ahead and just invest that in a ETF or mutual fund or wait until I can bulk it up? I was thinking of dumping and investing right away.

How do you guys start off investing? I am slowly throwing money into my brokerage account. So far I threw in like $200. Should I go ahead and just invest that in a ETF or mutual fund or wait until I can bulk it up? I was thinking of dumping and investing right away.

Depends on your preferred method of making profit. Do you want short term gains or long term gains because that's what ultimately dictate as to what stocks should be recommended for investing.

Depends on your preferred method of making profit. Do you want short term gains or long term gains because that's what ultimately dictate as to what stocks should be recommended for investing.

I am looking to park money for 5-10 years. I need to build my wealth for a down payment on a house. Savings account ain't cutting it..

Depends how much risk you want.I am looking to park money for 5-10 years. I need to build my wealth for a down payment on a house. Savings account ain't cutting it..

Single stocks have potentially more reward than a market ETF, but also much more risk. Maybe you choose to be more aggressive starting out, and get more conservative as you get 1-2 years from needing the money. Playing it safe you could go VTI/SPY for dependable long term returns. QQQ is more tech, should do better. If you don't want to be checking it every day or week, probably best to avoid individual stocks. You might also want to check the Retirement OT in the OP, and consider too getting started with a Roth or similar savings system with tax benefits.

Depends how much risk you want.

Single stocks have potentially more reward than a market ETF, but also much more risk. Maybe you choose to be more aggressive starting out, and get more conservative as you get 1-2 years from needing the money. Playing it safe you could go VTI/SPY for dependable long term returns. QQQ is more tech, should do better. If you don't want to be checking it every day or week, probably best to avoid individual stocks. You might also want to check the Retirement OT in the OP, and consider too getting started with a Roth or similar savings system with tax benefits.

Yes, I actually am going to start adding to my IRA. I just think I need to add more for wealth that I can liquidate. Because I need to start saving for a house. I just feel meh about renting in NYC still. It's expensive and I need more space.

Personally if I needed the money for a house in a few years I would just stick to safer index funds with a touch of growth.Yes, I actually am going to start adding to my IRA. I just think I need to add more for wealth that I can liquidate. Because I need to start saving for a house. I just feel meh about renting in NYC still. It's expensive and I need more space.

Even then, keeping your money in the stock market always has some risk. I remember last year one of my co workers was all set to buy a house, and then March hit and he was in sheer panic because he needed the money and it was just straight up crashing. So ultimately you'd probably want to monitor it as you get closer.

Personally if I needed the money for a house in a few years I would just stick to safer index funds with a touch of growth.

Even then, keeping your money in the stock market always has some risk. I remember last year one of my co workers was all set to buy a house, and then March hit and he was in sheer panic because he needed the money and it was just straight up crashing. So ultimately you'd probably want to monitor it as you get closer.

That's what I am aiming for. Safer index funds with a touch of growth. Which is why I opened up an account with Fidelity. I think I'll bea ble to move cash there and have everything run through Fidelity. I will be monitoring my portfolio every day, but just to make sure nothing looks funny. I already look at my IRA almost every day.

it's still up over 50% from this time last year... so uh... yeah.

Still crazy to me that they managed to get HBO's content and lower their stock more though.

I'm holding STOR and MPWWhat's a good long term REIT to look at ATM? Need to find some long term holds to roll amc earnings into.

Stock split

Stock split plus ATH breakout.

Streaming is yesterday's news. Theaters are the future.

😂🚀🚀🚀👩🚀👩🚀👩🚀🤣

What the hell happened with AMCX? I am up 17% today. Is it accidentally meming?

I am up 50% on it so ¯\_(ツ)_/¯

I am up 50% on it so ¯\_(ツ)_/¯

It is still going to get acquired at some point.

KindaWhat the hell happened with AMCX? I am up 17% today. Is it accidentally meming?

Its the collateral fuckery like this that makes me laugh the hardest man.

Personal Finance & Wealth Management | Breaking Stock Market News | Reuters

Find the latest personal finance & wealth management news from every corner of the globe at Reuters.com, your online source for breaking international market and finance news

Only for margin, apparently. This is the first step to becoming Robin Hood.

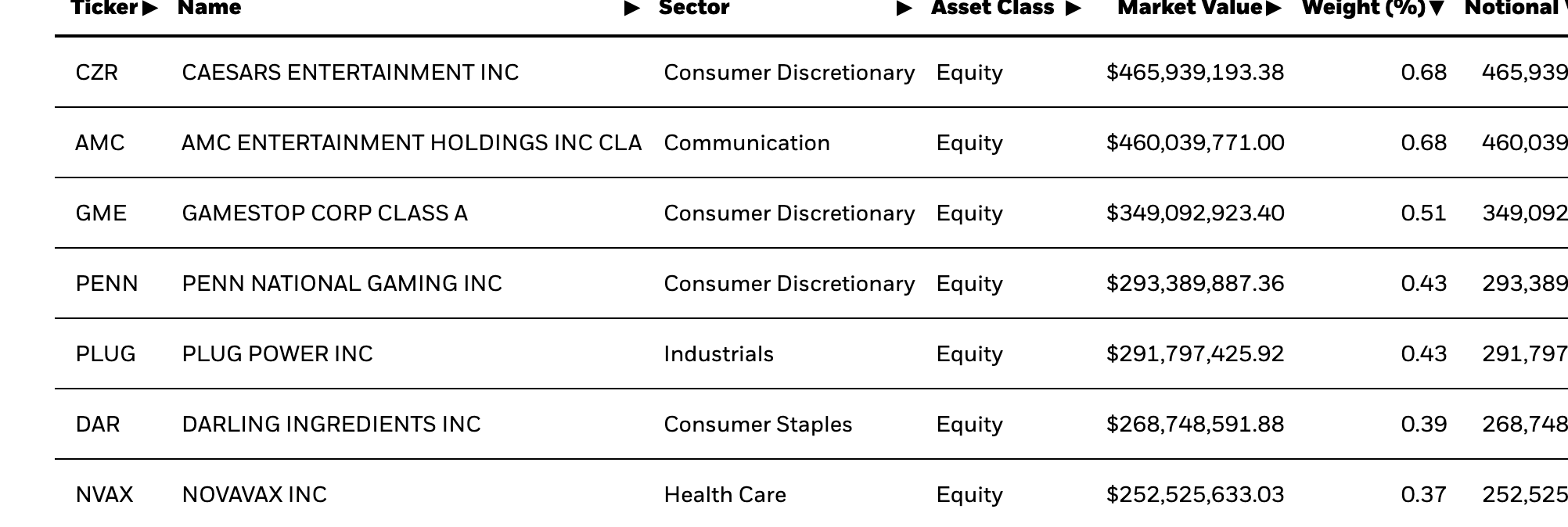

AMC insiders dumping.

(Bloomberg) -- AMC Entertainment Holdings Inc. executives and directors sold $8 million in shares of the theater chain Thursday, cashing in on the soaring price of the most-popular meme stock.

Two board members and four executives sold at near record prices, following an eye-popping surge in the stock this week, regulatory filings on Friday showed. Among them were Gary Locke, a former Chinese ambassador who is up for re-election to the board at the company's July 29 annual general meeting, and Carla Chavarria, the company's head of human resources.

Among the six people who sold, Chavarria reported the highest proceeds -- $2.53 million after selling more than 40,000 shares at $62.67. The stock made an all-time high of $72.62 a day earlier. Others who sold include John McDonald, executive vice president of U.S. operations; Daniel Ellis, senior vice president of development; Elizabeth Frank, chief content officer; and board member Anthony Saich.

(Bloomberg) -- AMC Entertainment Holdings Inc. executives and directors sold $8 million in shares of the theater chain Thursday, cashing in on the soaring price of the most-popular meme stock.

Two board members and four executives sold at near record prices, following an eye-popping surge in the stock this week, regulatory filings on Friday showed. Among them were Gary Locke, a former Chinese ambassador who is up for re-election to the board at the company's July 29 annual general meeting, and Carla Chavarria, the company's head of human resources.

Among the six people who sold, Chavarria reported the highest proceeds -- $2.53 million after selling more than 40,000 shares at $62.67. The stock made an all-time high of $72.62 a day earlier. Others who sold include John McDonald, executive vice president of U.S. operations; Daniel Ellis, senior vice president of development; Elizabeth Frank, chief content officer; and board member Anthony Saich.

Anyone able to point me towards the best way to just buy a single stock? I'm in Canada and have interest in just buying a single stock and am looking for the best, easiest, most efficient method. I know I can go through my banks stock purchasing program and buy that way. Or do I go through a broker to buy stock? I only wish to dump money into one stock and sit on it for many years.

Pretend I'm a complete moron and please toss me a bone on how best to proceed with minimal fees and minimal work.

Thank you 😃

Pretend I'm a complete moron and please toss me a bone on how best to proceed with minimal fees and minimal work.

Thank you 😃

Personal Finance & Wealth Management | Breaking Stock Market News | Reuters

Find the latest personal finance & wealth management news from every corner of the globe at Reuters.com, your online source for breaking international market and finance newswww.reuters.com

Only for margin, apparently. This is the first step to becoming Robin Hood.

They've had more restrictions for GME for months.

Could you recommend me a short term one?Depends on your preferred method of making profit. Do you want short term gains or long term gains because that's what ultimately dictate as to what stocks should be recommended for investing.

Just advice: Don't put your eggs all in one basket. No matter how untouchable you think a company is today, they could fade into obscurity by the time you're retired. At the very least, invest in something like an ETF, which is basically a shortcut to owning fractional shares of many different companies in one tidy package. Some ETF's are broad and hold many stocks in a variety of industries, like Index ETF's, while others are focused on specific industries, like tech or real estate. But most financial planners would strongly advise that you not concentrate on just a single industry.Anyone able to point me towards the best way to just buy a single stock? I'm in Canada and have interest in just buying a single stock and am looking for the best, easiest, most efficient method. I know I can go through my banks stock purchasing program and buy that way. Or do I go through a broker to buy stock? I only wish to dump money into one stock and sit on it for many years.

Pretend I'm a complete moron and please toss me a bone on how best to proceed with minimal fees and minimal work.

Thank you 😃

Just advice: Don't put your eggs all in one basket. No matter how untouchable you think a company is today, they could fade into obscurity by the time you're retired. At the very least, invest in something like an ETF, which is basically a shortcut to owning fractional shares of many different companies in one tidy package. Some ETF's are broad and hold many stocks in a variety of industries, like Index ETF's, while others are focused on specific industries, like tech or real estate. But most financial planners would strongly advise that you not concentrate on just a single industry.

Thanks for the advice. No need to worry in this case, this is just a one time purchase for my own reasons. Just trying to figure the easiest and best way to actually purchase the stocks

Reddit - Dive into anything

This subreddit is dedicated to penny stocks, they're very volatile but they give you strong short term gains if you invest smartly. If you want to expand your portfolio in the short term beyond meme stocks then that's the way to go.