lol. I have no position either way, but I'm worried a lot of naïve investors are going to be suckered in. You aren't helping.As someone that has been following this for months, if you think this is a pump and dump, you are on extreme levels of copium right now.

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Threadmarks

View all 9 threadmarks

Reader mode

Reader mode

Recent threadmarks

$70! Trading halted on various platforms Opening above $100 on 1/25 Flirting with 300 in premarket on 1/27 Please move general stock talk to Stock Market Era 1/27 close at 347; indraday high of 380 Biden moving at record speed; Unity incoming 1/28 - closed at 193.60lol. I have no position either way, but I'm worried a lot of naïve investors are going to be suckered in. You aren't helping.

we hit the top

lol. I have no position either way, but I'm worried a lot of naïve investors are going to be suckered in. You aren't helping.

Yeah, this. Got to push the FOMO to keep the pump going.

You think now in this industry and retail environment a company like GameStop should be worth more than it has ever been? Why?As someone that has been following this for months, if you think this is a pump and dump, you are on extreme levels of copium right now.

You know what they say about people who project extreme confidence in a stockAs someone that has been following this for months, if you think this is a pump and dump, you are on extreme levels of copium right now.

(I actually don't know what they say but I'm assuming there's a saying)

Honestly wondering if this'll be looked at as market manipulation. I know the position of WSB is that it can't be since there's no central leadership directing it.

But I mean, come the fuck on, there's no way GameStop is worth this much even if they open the build a PC stores. This price is artificially inflated as fuck.

But I mean, come the fuck on, there's no way GameStop is worth this much even if they open the build a PC stores. This price is artificially inflated as fuck.

This current development is caused by loads of people betting on Gamestop going bust over the past couple of years.

But initial physical/digital cut of next-gen looks quite good for physical and promising developments in Gamestops leadership created expectations of them turning the business around and finding a gaming e-commerce niche in which they will be able to work through physical-digital transformations in the market and stay relevant.

Basically, this current development just means that Gamestop isn't dead just yet and those who bet on it dying are getting fucked.

But it doesn't say much about Gamestop's future.

For that, we will need to wait for how Gamestop actually goes about restructuring its business. Personally, I think it is not unlikely that Gamestop will pull off a successful turnaround.

But the current stock price is just a result of the short positions being sqeezed. It doesn't reflect anything about Gamestop's current business or prospects.

Does anyone remember when VW went up to above 1000€ a share during the financial crisis?

This was also a short squeeze. Hedge funds had bet on VW going down when Porsche announced it would want to increase its stake to eventually a majority. Since 20% of VW are traditionally held by some german state government only a small percentage of shares were free and prices skyrocketed as hedge funds tried to cover their short positions. The prices went so high that Porsche was unable to raise enough capital to take over a majority stake in VW, though, and eventually, the thing normalized again.

Porsche shortly held a majority, but its own debt had increased to dangerous levels because of it, so they eventually backed down.

This was back in 2008 and I was in school back then and we did a virtual stock market game in our economics class.

We traded with virtual capital but real stocks for like a semester. Usually the winners (this was between many schools, so loads of participants) doubled their positions over the course of these few months.

But this year, because the market was so crazy, the luckiest groups increased their positions value 10 fold, even 20 fold.

But just the same, losses were by an order of magnitude more pronounced than in other years.

Short squeezes are once in decade opportunities and seem to become more likely in turbulent market situations.

It is hard to identify potential ones.

Basically, you need to find a company that is on a predictable downward trajectory and shorted to hell and back, while a turnaround approaches quickly and doesn't leave time for the holder of the short positions to get out or cover.

In Gamestop's case the turnaround came in the form of new leadership with robust e-commerce experience and a new console generation which provided initial assurance that physical sales might not be a thing of the past just yet.

That said, imagine last March, markets had just crashed, people were in quarantine, lockdowns with no end in sight. Massive capital injections by the central banks expected but not yet certain and even then, with uncertain effects.

Who would bet on a used physical games business in that time? Or rather, would get out of a bet against this business at that time.

This year on Christmas I visited my parents in my hometown. As is usual I contacted some old friends from school and went for a walk with one guy who works in investment banking.

We talked about all kinds of things, also finances and at some point, he told me about this thing he has going with Gamestop stock.

He probably didn't even expect me to know what Gamestop is, so when I showed some interest he told me, all giddy, about the potential short squeeze and the Chewy guy coming int etc.

He is in a really good mood now. The price hovered below 20$ at the time, he went in at below 10.

Last edited:

This is all fun and games until folks lose serious dough.

For those that are late to the party, stay away from this shit. If you yolo bought before the launch of next-gen, congrats. Sell now while you can, and put that money into real blue chippers.

For those that are late to the party, stay away from this shit. If you yolo bought before the launch of next-gen, congrats. Sell now while you can, and put that money into real blue chippers.

What do you think the proper valuation is?As someone that has been following this for months, if you think this is a pump and dump, you are on extreme levels of copium right now.

I recognized back in August that I thought they were undervalued. But to be trading at $150 a share? That's not a function of market fundamental analysis here.

lol. I have no position either way, but I'm worried a lot of naïve investors are going to be suckered in. You aren't helping.

GameStop (GME) Stock Surges Amidst New Board, Short Squeeze [Read Threadmarks] News

With all the doom and gloom surrounding GameStop here over the last year or so, I figured I'd share this information. Key Takeaways: Ryan Cohen, owner of Chewy.com, had a substantial take in the company and was recently elected to the Board of Directors Massive short squeeze imminent...

You were saying?

You think now in this industry and retail environment a company like GameStop should be worth more than it has ever been? Why?

That's not what I'm saying. A year+ long time of people doing research and getting into GME early BEFORE anyone knew about a short squeeze is not a pump and dump. The guy considered to be one who started this play on WSB is still holding. He has held through days of severe losses. That's not a pump and dump.

Honestly wondering if this'll be looked at as market manipulation. I know the position of WSB is that it can't be since there's no central leadership directing it.

But I mean, come the fuck on, there's no way GameStop is worth this much even if they open the build a PC stores. This price is artificially inflated as fuck.

The price is so high because people want to cover their short positions and this demand drives up the price.

It may be artificially high right now, but that is not caused by WSB but by the shorters who need to cover.

But yeah, the 2008 VW short squeeze is still concerning courts to this day, but in the Gamestop case, I just don't see any behavior that might even resemble objectionable action.

People just found out an over shorted stock and shared that knowledge on reddit. That is not illegal.

that's when the real fun begins

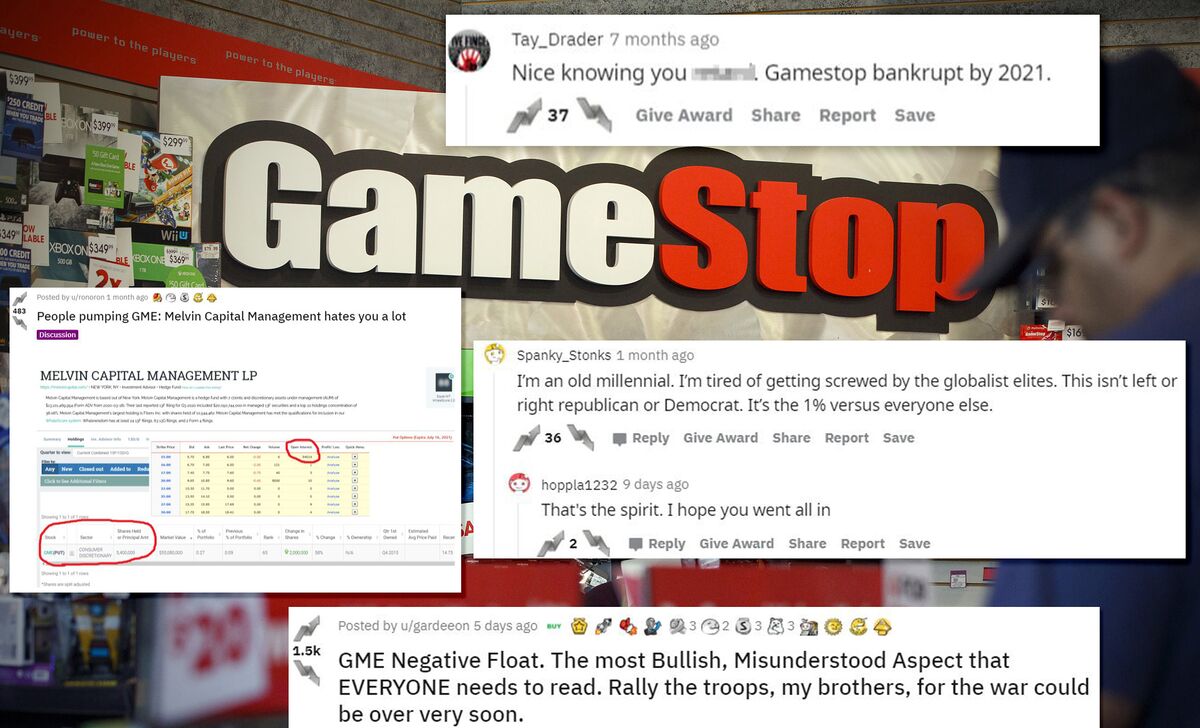

How WallStreetBets Pushed GameStop Shares to the Moon

Short sellers have been called a lot of things. Bloodsuckers. Parasites. Other words not fit to print. Now in the vortex engulfing GameStop Corp., they have a new name: the establishment.

That's not what I'm saying. A year+ long time of people doing research and getting into GME early BEFORE anyone knew about a short squeeze is not a pump and dump. The guy considered to be one who started this play on WSB is still holding. He has held through days of severe losses. That's not a pump and dump.

Can't it be both? Can't there be legitimate reasons to see growth in GME and then a bunch of internet memelords HODL the 🚀 4 lulz, and cause the stock to be pumped up?

In the short (very short term) yes.

Can't it be both? Can't there be legitimate reasons to see growth in GME and then a bunch of internet memelords HODL the 🚀 4 lulz, and cause the stock to be pumped up?

Of course. Read the Bloomberg article posted right before this. The initial GME play was that it was good value + coming up on a console cycle. The short squeeze play (which is what this is) came much later. There is actual value in GME due to people like Ryan Cohen coming into play, but that's not what's driving the current price. Nobody knows what GME will be worth in a few years. It could go full e-commerce and prosper or it could continue to struggle. But the big takeaway here is that there isn't some scheme going on to manipulate the price. The price is skyrocketing because of the shorts. The only thing WSB is doing to "manipulate" this is telling shareholders not to sell. This is a case of big money vs. retail traders (WSB).

Last edited:

To be fair, lots of fat cats on Wall Street are already fucked. Fuck em.

However, I am against the hype behind this stock because it will lead to regular people losing lots of money on a false hope.

I'm holding up. Luckily this cash is helping me dry my eyes.

I'm not sure. Sold all my shares on Friday. So watching this balloon to 150. I was like "OH SHIT THAT'S THE CAR PAYMENT FOR 2 YEARS but then I chilled because I already made out huge. I want everyone to eat!

Can't wait to revisit this thread in 2 weeks.

If you're not a registered investment business/financial advisor and don't have legal ties to a company otherwise you can say whatever the fuck you want to people on the internet.

If you're not a registered investment business/financial advisor and don't have legal ties to a company otherwise you can say whatever the fuck you want to people on the internet.

This isn't a pump and dump tho

Of course. Read the Bloomberg article posted right before this. The initial GME play was that it was good value + coming up on a console cycle. The short squeeze play (which is what this is) came much later. There is actual value in GME due to people like Ryan Cohen coming into play, but that's not what's driving the current price. Nobody knows what GME will be worth in a few years. It could go full e-commerce and prosper or it could continue to struggle. But the big takeaway here is that there isn't some scheme going on to manipulate the price. The price is skyrocketing because of the shorts. The only thing WSB is doing to "manipulate" this is telling shareholders not to tell. This is a case of big money vs. retail traders (WSB).

I just read that article, and I am actually kind of impressed now. It seems like the short sellers on Wall Street were the ones manipulating, and WSB threw a spanner in their works. As much as it's artificially high now, it may have been artificially low then.

this is not a pump, everyone who keeps saying that doesn't understand what is going on. The long term prospects of the company are still grim, what this is , is a short squeeze of a stock that was heavily sold short, there were more shorts than there were shares. So, even though everyone knows the writing is on the wall for the companies future, in the short term, the stock traders had gone way overboard. Now it is correcting, not the price to a fair market value, but correcting the huge short position.

GME hit ATHs that were nearly three times that of past peaks of both prior generations (In-stock console feeding frenzy of Holiday 2007 and the PS4/XBO launch in 2013). Wow.

not exactly. For some, maybe, but this is going to take out a bunch of hedge funds too. There will be multiple trading companies that get destroyed by this short squeeze, especially Options traders.

S t o n k s

pretty fucked up how some people will get investigated if they sell due to that subreddit

Shows how fucking dumb stocks are

pretty fucked up how some people will get investigated if they sell due to that subreddit

Shows how fucking dumb stocks are

This was to be expected. GME hit the circuit breakers twice this morning. The dip was to be expected. BUY THE DIP AND HOLD!

GME hit ATHs that were nearly three times that of past peaks of both prior generations (In-stock console feeding frenzy of Holiday 2007 and the PS4/XBO launch in 2013). Wow.

It just lost half its value from today's high and its still 17% higher than it's ever been. Insane!!!!

not exactly. For some, maybe, but this is going to take out a bunch of hedge funds too. There will be multiple trading companies that get destroyed by this short squeeze, especially Options traders.

could you elaborate? I'm clueless

He's saying that many investment companies shorted the stock (i.e. gambled that the company would lose value) which means that, when the stock jumped up 60%, they were forced to rebuy the stock on a higher price. Depending on how many shares they tried to short, it could have resulted in millions of dollars in loss potentially.

Its not a pump and dump in the sense that someone will be fined by the SEC (I mean, as far as we know right now, could theoretically be an investigation behind the scenes based on nonpublic info). But look at all the people that literally don't even know how to buy a stock without asking for help on a video game forum and are trying to get on this train because they see numbers going up and are hyped. Thats very bad! They really really shouldn't do that.As someone that has been following this for months, if you think this is a pump and dump, you are on extreme levels of copium right now.

or they just weathered the storm, knowing that a bunch of nerds on Reddit wouldn't have the intestinal fortitude for this kind of action when it turns against them.He's saying that many investment companies shorted the stock (i.e. gambled that the company would lose value) which means that, when the stock jumped up 60%, they were forced to rebuy the stock on a higher price. Depending on how many shares they tried to short, it could have resulted in millions of dollars in loss potentially.

These firms have been playing this game for a long time now, and often with much more sophisticated opponents...

Exactly right. Reading through that subreddit will quickly make you realize just how little experience these guys collectively have.Firms aren't going to go under even losing hundreds of millions on this. its not like they only have exactly 1 position all short on GameStop lol (unlike all of the newbs jumping on the train this week :P)

S t o n k s

pretty fucked up how some people will get investigated if they sell due to that subreddit

Shows how fucking dumb stocks are

No, this statement shows that you don't know much about how this works.

The price is so high because people want to cover their short positions and this demand drives up the price.

It may be artificially high right now, but that is not caused by WSB but by the shorters who need to cover.

But yeah, the 2008 VW short squeeze is still concerning courts to this day, but in the Gamestop case, I just don't see any behavior that might even resemble objectionable action.

People just found out an over shorted stock and shared that knowledge on reddit. That is not illegal.

yeah I don't think I thought it through before posting. Just weird that a company is gaining billions in value just because of dumb investors

Its not a pump and dump in the sense that someone will be fined by the SEC (I mean, as far as we know right now, could theoretically be an investigation behind the scenes based on nonpublic info). But look at all the people that literally don't even know how to buy a stock without asking for help on a video game forum and are trying to get on this train because they see numbers going up and are hyped. Thats very bad! They really really shouldn't do that.

I've used the opportunity to learn about stocks. I put very little in but I have learned quite a bit in the last two days.

Its not a pump and dump in the sense that someone will be fined by the SEC (I mean, as far as we know right now, could theoretically be an investigation behind the scenes based on nonpublic info). But look at all the people that literally don't even know how to buy a stock without asking for help on a video game forum and are trying to get on this train because they see numbers going up and are hyped. Thats very bad! They really really shouldn't do that.

FOMO will always exist and is on the individual to make wise choices based on their own situation and perceived value of risk/reward. If someone comes into this thread and throws money at GME without even looking at a day chart, that's on them. There's plenty of people in this thread explaining why this is happening and providing solid advice. If that advice is ignored, it's silly to focus on a handful of individuals willing to gamble their life away without understanding what they're doing. This applies to various things in life and is not limited to the stock market.

So did that friend of yours, um, happen to mention any other stocks? ;)This year on Christmas I visited my parents in my hometown. As is usual I contacted some old friends from school and went for a walk with one guy who works in investment banking.

We talked about all kinds of things, also finances and at some point, he told me about this thing he has going with Gamestop stock.

He probably didn't even expect me to know what Gamestop is, so when I showed some interest he told me, all giddy, about the potential short squeeze and the Chewy guy coming int etc.

He is in a really good mood now. The price hovered below 20$ at the time, he went in at below 10.

Threadmarks

View all 9 threadmarks

Reader mode

Reader mode