and buy the dip, right right right???

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

Retirement-Era |OT| How to Invest For Retirement

- Thread starter TheTrinity

- Start date

- OT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Don't time the dip, just buy at your regularly scheduled dates DAMNIT NETMAPEL KEEP IT TOGETHER

DAMMIT SMILEY THIS IS CANADA I DO WHAT I WANT DON'T TELL ME WHAT TO DO!Don't time the dip, just buy at your regularly scheduled dates DAMNIT NETMAPEL KEEP IT TOGETHER

Everybody listen to Smiley. Dollar cost average is your friend. I got monthly automated contribution so we in this together!

Well I'm buying the dip. Just increasing my regular contributions, but buying the dip nonetheless.

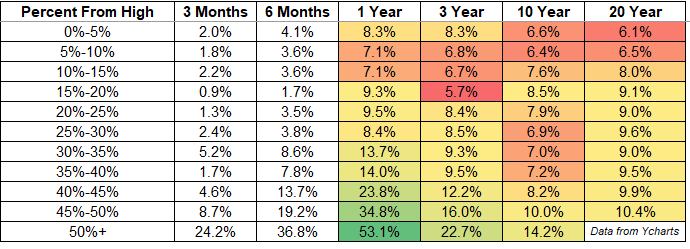

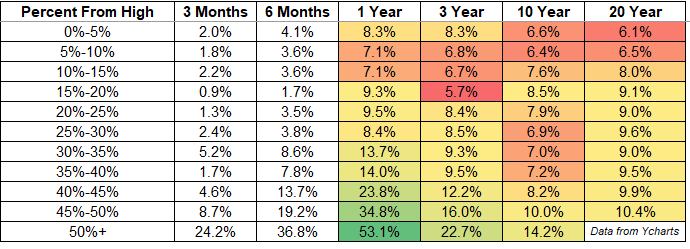

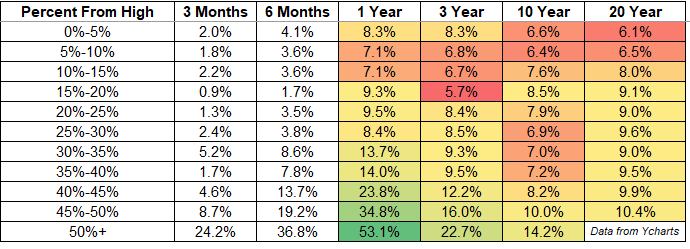

History is starting to be on the side to those who start putting in money now but in the short term of the next year there could still be a lot of pain.

theirrelevantinvestor.com

theirrelevantinvestor.com

What Happens After the Stock Market Falls? - The Irrelevant Investor

Be prepared for anything.

I maxed out my IRA in January, and decided to up my contributions to max out my 401k early starting in mid-February.

That decision looked pretty bad for a bit there, but I've held steady with the increased contributions. The way things are looking, I'm guessing I at least have a shot at breaking even in terms of "timing the market", as half my tax-advantaged contributions for the year will be near peak, and the other half will be in this dip.

I'm not looking at the numbers or doing the math though, since I don't want to be tempted to change my plans. I've got nearly 30 years to go. Just let it ride.

That decision looked pretty bad for a bit there, but I've held steady with the increased contributions. The way things are looking, I'm guessing I at least have a shot at breaking even in terms of "timing the market", as half my tax-advantaged contributions for the year will be near peak, and the other half will be in this dip.

I'm not looking at the numbers or doing the math though, since I don't want to be tempted to change my plans. I've got nearly 30 years to go. Just let it ride.

We sold a bunch near 'the top' but unfortunately that's because we need it to buy a house lol. No buying the dip for us.

"Unfortunately" for me, all my investments are tax-sheltered so there isn't much to do at all. I think my wife and I are weathering it pretty well actually. I wasn't sure how I would feel about massive drops but I feel totally fine since I know I'm not selling. Business as usual as far as investments go.

I have more in pure cash in HISA than I do in retirement investments because I was planning a major renovation in a few months but.. now.. what.. I don't suppose contractors will want to be showing up during peak pandemic lol.

Well, at least I can feel secure that I just have a bunch of cash on hand in case the market continues going awry and some emergency crops up.

Well, at least I can feel secure that I just have a bunch of cash on hand in case the market continues going awry and some emergency crops up.

History is starting to be on the side to those who start putting in money now but in the short term of the next year there could still be a lot of pain.

What Happens After the Stock Market Falls? - The Irrelevant Investor

Be prepared for anything.theirrelevantinvestor.com

If you are years from retiring: every time you buy in a falling market is a discount on yesterday.

Hi everyone-

I hardly post to ERA but I read it on the daily, and have been following this thread the past few weeks as this situation has unfolded. A brief history about myself before I ask my question: my wife and I are both public employees with associated retirements through our unions. A few years back we both set up small additional retirements funds cause we had the extra cash, in general however we don't have a ton of disposable income. With everything that's happening our family/friends have suggested we try to invest in the market since our jobs are relatively stable and we will likely be in the same position financially when things start to recover.

My question: we have ZERO experience doing any of this ourselves. We know next to nothing about the market or what steps to take to invest. Every time I try to read up my head explodes with the jargon and I get overwhelmed. Do you have any suggestions for someone who is just starting out and has literally NO experience? Or am I better off just finding someone to invest for me?

I hardly post to ERA but I read it on the daily, and have been following this thread the past few weeks as this situation has unfolded. A brief history about myself before I ask my question: my wife and I are both public employees with associated retirements through our unions. A few years back we both set up small additional retirements funds cause we had the extra cash, in general however we don't have a ton of disposable income. With everything that's happening our family/friends have suggested we try to invest in the market since our jobs are relatively stable and we will likely be in the same position financially when things start to recover.

My question: we have ZERO experience doing any of this ourselves. We know next to nothing about the market or what steps to take to invest. Every time I try to read up my head explodes with the jargon and I get overwhelmed. Do you have any suggestions for someone who is just starting out and has literally NO experience? Or am I better off just finding someone to invest for me?

You don't need a pro to stick it all in a low cost ETF like SPY, VTI, QQQ, which also offer dividends. Start there and as you learn more and get more comfortable, then maybe consider individual stocks, being careful not to be too overweight in any one stock or sector.Hi everyone-

I hardly post to ERA but I read it on the daily, and have been following this thread the past few weeks as this situation has unfolded. A brief history about myself before I ask my question: my wife and I are both public employees with associated retirements through our unions. A few years back we both set up small additional retirements funds cause we had the extra cash, in general however we don't have a ton of disposable income. With everything that's happening our family/friends have suggested we try to invest in the market since our jobs are relatively stable and we will likely be in the same position financially when things start to recover.

My question: we have ZERO experience doing any of this ourselves. We know next to nothing about the market or what steps to take to invest. Every time I try to read up my head explodes with the jargon and I get overwhelmed. Do you have any suggestions for someone who is just starting out and has literally NO experience? Or am I better off just finding someone to invest for me?

If your job is stable it's a great time to increase contributions.

If you aren't investing in anything at the moment and want to keep things stupid simple just make a Vanguard account and throw the money in the target date fund closest to your anticipated retirement date. That's about as "set and forget" as you can get for a retirement account. You can also set up auto-invest for reoccurring contributions (not with ETFs though, only mutual funds).

If you aren't investing in anything at the moment and want to keep things stupid simple just make a Vanguard account and throw the money in the target date fund closest to your anticipated retirement date. That's about as "set and forget" as you can get for a retirement account. You can also set up auto-invest for reoccurring contributions (not with ETFs though, only mutual funds).

I have a question which I'm not sure there is a right answer: I have had my 401k and ira set to aggressive for a while now and of course have lost a lot these past few weeks. Should I have changed it to a conservative setting before this all started? Is it dumb to change it now?

I have a question which I'm not sure there is a right answer: I have had my 401k and ira set to aggressive for a while now and of course have lost a lot these past few weeks. Should I have changed it to a conservative setting before this all started? Is it dumb to change it now?

Just keep everything on aggressive if you have a long time window.

If you change it to conservative now you're literally the guy who buys high and sells low. Just forget about it alltogether and stay the course, it's the best you can do. Never try to time the market, you don't know when it'll go down or up. Hindsight is always 20/20, never think "oh if I did this a month ago i would've made so much money".

Yea I'm only 31 so I have a long time. Thanks, I'll try my best to ignore it lol. But in the future if something similar to this happens, would it have been better to change it more towards the beginning of the free fall? Not trying to make a ton of money, just mitigate my losses. I'm still sad I put in my 2019 IRA fund literally a week before this started. Feels like it's just vanished lolJust keep everything on aggressive if you have a long time window.

If you change it to conservative now you're literally the guy who buys high and sells low. Just forget about it alltogether and stay the course, it's the best you can do. Never try to time the market, you don't know when it'll go down or up. Hindsight is always 20/20, never think "oh if I did this a month ago i would've made so much money".

In theory yes, in reality not really because you're generally not going to effectively tell the difference between what's going to be a small drop and bounce back, and what's going to be a big drop like the current one. Don't day trade your retirement savings. Obviously some people do that to an extent (we've had people on Era or maybe back in the day on GAF that did that) but as general advice, don't do it.Yea I'm only 31 so I have a long time. Thanks, I'll try my best to ignore it lol. But in the future if something similar to this happens, would it have been better to change it more towards the beginning of the free fall? Not trying to make a ton of money, just mitigate my losses. I'm still sad I put in my 2019 IRA fund literally a week before this started. Feels like it's just vanished lol

For retirement: Time in the market is better than timing the market

As someone who is also 31 I'm more concerned about the number of shares than the value of the shares for now. Given time the value will increase, so I just want to accumulate as many as possible. Obviously it would have been better to invest in my Roth now rather than in January, but hindsight is 20/20. No sense in dwelling on it, instead I'm just taking advantage the best I can by temporarily increasing my 401k contributions.

Gotcha, thanks. It seems like everybody is recommending to get more contributions in right now even though we don't know just how much worse it could get. I'll have to increase to what I can and try not to open my account every day lolIn theory yes, in reality not really because you're generally not going to effectively tell the difference between what's going to be a small drop and bounce back, and what's going to be a big drop like the current one. Don't day trade your retirement savings. Obviously some people do that to an extent (we've had people on Era or maybe back in the day on GAF that did that) but as general advice, don't do it.

For retirement: Time in the market is better than timing the market

As someone who is also 31 I'm more concerned about the number of shares than the value of the shares for now. Given time the value will increase, so I just want to accumulate as many as possible. Obviously it would have been better to invest in my Roth now rather than in January, but hindsight is 20/20. No sense in dwelling on it, instead I'm just taking advantage the best I can by temporarily increasing my 401k contributions.

Yea I'm only 31 so I have a long time. Thanks, I'll try my best to ignore it lol. But in the future if something similar to this happens, would it have been better to change it more towards the beginning of the free fall? Not trying to make a ton of money, just mitigate my losses. I'm still sad I put in my 2019 IRA fund literally a week before this started. Feels like it's just vanished lol

No it wouldn't have. because if you had the ability to accurately predict a free fall every time you'd make several million dollars a year managing a hedge fund.

ALAS what was equally likely to happen is that you see, say, a 3% drop one day, think it's about to go into free fall, change to conservative and then it gains 10% in a re-bound the next day and you just lost out on all the potential gains you could've made if you just held on.

Never try to time the market. never!

Historically, that is sound advice, especially for someone who is new. You should definitely be careful with individual stocks right now though, with earnings season approaching.Gotcha, thanks. It seems like everybody is recommending to get more contributions in right now even though we don't know just how much worse it could get. I'll have to increase to what I can and try not to open my account every day lol

As far as I know, I'm not dealing with individual stocks, I don't think. I just have my 401k and IRA right now, though those are mostly made up of stocksHistorically, that is sound advice, especially for someone who is new. You should definitely be careful with individual stocks right now though, with earnings season approaching.

I really don't know what to do. I work for a big financial firm, and we have a dept that helps employees with financial questions. I'm going to set up an appointment tomorrow for advice, but I know they will just suggest mutual funds...

1. I'll be 38 in two months

2. I roughly make, with OT close to $60k

3. I have as of now around $8500 in my savings account at bank

4. 401k I have 90% that tracks SP500 and 10% is some dividend fund. I contribute 14% to my 401K

5. I have an individual taxable account. It currently holds:

-$11k in money market fund

-10 shares of AAPL

-10 shares of NVDA

-10 shares of V

-30 shares of O

-15 shares of PPA

-10 shares of VUG

-10 shares of XLV

The amount invested totals around $23k. I made nice gains on AAPL from when I bought last August. I bought V, O, and NVDA in January and also made pretty nice gains before the market crash.

my number one goal is to retire safely. I need some advice on what to do, ERA. :(

1. Should I open a ROTH?

2. if so, should It be in ETFs or mutual funds?

3. If ETFs, are any of my current ETFs I listed above good enough to contribute monthly?

4. I have too much in my money market fund. I know. How much should I leave in there?

5. Should I leave my IND taxable account open? If so what I'm my current holdings keep? Sell?

I can estimate I can spend $200-$300 a month on buying more shares. It seems if ETFs are the way to go, are my ETFs good enough to continue contributing to help in safely retiring? If not, What 3-4 ETFs would you choose in my situation? Thank you all for the help. :(

1. I'll be 38 in two months

2. I roughly make, with OT close to $60k

3. I have as of now around $8500 in my savings account at bank

4. 401k I have 90% that tracks SP500 and 10% is some dividend fund. I contribute 14% to my 401K

5. I have an individual taxable account. It currently holds:

-$11k in money market fund

-10 shares of AAPL

-10 shares of NVDA

-10 shares of V

-30 shares of O

-15 shares of PPA

-10 shares of VUG

-10 shares of XLV

The amount invested totals around $23k. I made nice gains on AAPL from when I bought last August. I bought V, O, and NVDA in January and also made pretty nice gains before the market crash.

my number one goal is to retire safely. I need some advice on what to do, ERA. :(

1. Should I open a ROTH?

2. if so, should It be in ETFs or mutual funds?

3. If ETFs, are any of my current ETFs I listed above good enough to contribute monthly?

4. I have too much in my money market fund. I know. How much should I leave in there?

5. Should I leave my IND taxable account open? If so what I'm my current holdings keep? Sell?

I can estimate I can spend $200-$300 a month on buying more shares. It seems if ETFs are the way to go, are my ETFs good enough to continue contributing to help in safely retiring? If not, What 3-4 ETFs would you choose in my situation? Thank you all for the help. :(

That all looks very sensible to me, especially for your age. Yes, do a Roth too. Continue what you're doing with the ETF's and staying diversified like that. The next few months will likely be rough for some companies more than others as they report earnings (or lack of) and lower guidance, but you're well positioned to handle the volatility, and still quite young.I really don't know what to do. I work for a big financial firm, and we have a dept that helps employees with financial questions. I'm going to set up an appointment tomorrow for advice, but I know they will just suggest mutual funds...

1. I'll be 38 in two months

2. I roughly make, with OT close to $60k

3. I have as of now around $8500 in my savings account at bank

4. 401k I have 90% that tracks SP500 and 10% is some dividend fund. I contribute 14% to my 401K

5. I have an individual taxable account. It currently holds:

-$11k in money market fund

-10 shares of AAPL

-10 shares of NVDA

-10 shares of V

-30 shares of O

-15 shares of PPA

-10 shares of VUG

-10 shares of XLV

The amount invested totals around $23k. I made nice gains on AAPL from when I bought last August. I bought V, O, and NVDA in January and also made pretty nice gains before the market crash.

my number one goal is to retire safely. I need some advice on what to do, ERA. :(

1. Should I open a ROTH?

2. if so, should It be in ETFs or mutual funds?

3. If ETFs, are any of my current ETFs I listed above good enough to contribute monthly?

4. I have too much in my money market fund. I know. How much should I leave in there?

5. Should I leave my IND taxable account open? If so what I'm my current holdings keep? Sell?

I can estimate I can spend $200-$300 a month on buying more shares. It seems if ETFs are the way to go, are my ETFs good enough to continue contributing to help in safely retiring? If not, What 3-4 ETFs would you choose in my situation? Thank you all for the help. :(

It might have been good to change up that 90% in the S&P500 before the crash, but now it's probably too late to change it, may as well ride it out from here.

Are the ETFs I currently hold good enough to continue holding and do DCA? I can't afford to buy more AAPL, NVDA, and V. id be buying like one share per month. I need to find securities that are under $100 per share.

im thinking of selling my blue chip stocks when they start to gain again, and just put the money i earned into ETFs.

If I put in $5000 into mutual funds for a Roth, and do an automatic investment plan $100 for each fund a month, long term horizon, would i not earn quite a bit to help in retirement?

I'm just scared I won't make enough for retirement and that's why I need help.

im thinking of selling my blue chip stocks when they start to gain again, and just put the money i earned into ETFs.

If I put in $5000 into mutual funds for a Roth, and do an automatic investment plan $100 for each fund a month, long term horizon, would i not earn quite a bit to help in retirement?

I'm just scared I won't make enough for retirement and that's why I need help.

1. Should I open a ROTH?

2. if so, should It be in ETFs or mutual funds?

3. If ETFs, are any of my current ETFs I listed above good enough to contribute monthly?

4. I have too much in my money market fund. I know. How much should I leave in there?

5. Should I leave my IND taxable account open? If so what I'm my current holdings keep? Sell?

I can estimate I can spend $200-$300 a month on buying more shares. It seems if ETFs are the way to go, are my ETFs good enough to continue contributing to help in safely retiring? If not, What 3-4 ETFs would you choose in my situation? Thank you all for the help. :(

Disclaimer 1: I am not a financial advisor/planner, so take this with however much salt you like

Disclaimer 2: I use Vanguard and am mostly familiar with them, but don't intend to be biased toward them

Disclaimer 3: I could have just said "read the OP and second post" because most of this is covered there, but I wrote all this before I realized that.

ETF vs mutual fund: For retirement, they are functionally the same. A lot of index funds are available as both. At least in the case of Vanguard, mutual funds allow for automatic investment (like a monthly bank transfer to your investment). ETFs do not. But Vanguard's mutual funds have investment minimums, commonly around $3000. ETFs are bought as shares, so the minimum cost is the cost of a share. And Fidelity has $0 minimum mutual funds which may combine the best of both.

For Roth vs Traditional: A Roth has taxes paid now, but no taxes when you retire. Traditional has you pay taxes when you retire but no tax now. Both grow tax free.

Ultimately the key difference is, do you anticipate your tax burden to be higher when you retire, or do you think it's higher now? This includes both earnings and anticipated tax rates - taxes might be higher 30 years from now. Or maybe they will be similar. Who knows? Hell maybe they will be lower. Anything could happen.

If you think your tax burden is higher now, Traditional is the way to go. The tax deferred investment comes off the top, from your highest bracket. Otherwise, a Roth is better. Pay lower tax rates at the present and avoid the higher taxes in the future.

There's also the HSA (Health Savings Account). If you qualify and use it correctly it's triple tax advantaged - contributions are pre-tax (like a Traditional IRA), withdraws are tax free* (like a Roth), and growth is tax free (like both). You can invest money in your HSA, but the general downside is HSA providers aren't as good as IRA providers, so investment options are worse and have more fees.

(Important to note the *, withdraws have to be used for qualifying expenses or they aren't tax free.)

For the money market fund:

If it's for retirement, it should be $0 (or as close as possible with ETFs). Don't invest in cash because it will only lose value to inflation. Even the highest interest accounts are, at best, merely going to keep up and not make real gains.

As an emergency fund, advice varies and depends on your personal situation. 3 to 6 months of living expenses is the generally recommended range, though you get more extremes like a year (very conservative) or even nothing (very aggressive). I'd lean toward something in that 3-6 month range that you find comfortable based on how quickly you think you could get back on your feet.

For funds: Depends on your risk tolerance and how much effort you want to put in.

If you want to set it and forget it, buy into a target date fund. Vanguard's 2045 fund is a great choice. Usually I also suggest Fidelity alternatives (I use Vanguard and don't intend to be biased) but their equivalent funds have much higher fees, to the extent I can't really recommend them.

Beyond that it just depends on how much control you want. If you want some control over your asset mix but don't want to get too deep, you can just do a total market stock (Vanguard, Fidelity) and bond (Vanguard, Fidelity) fund. More stock = more risk, but more potential gains. More bonds = less risk, but reduced gain potential. You want more bonds as you get closer to retirement so if the market takes a dive like right now, your retirement funds aren't shot right before you need them. The target date funds can help give an idea for different mixes.

You can basically fine tune however much you want. You could add an international index. Or go even further and break down your total market fund into segments (large/mid/small cap) to tilt and fine tune your risk/reward. But that's getting into a rabbit hole.

If you're 38 and haven't been adequately investing, you probably want to be fairly aggressive with your approach to try and "catch up." I.e., fewer bonds than the target date fund might recommend. Maybe instead of the 2045 fund you do something further off, like 2055 or 2060 with more aggressive allocations and earnings potential. With the market being down like it is, this is (historically) a great time to get in. Things will eventually, probably, hopefully, get back to "normal" and that goes for the market too.

Last edited:

Thanks guys. I have an appointment tomorrow morning with our associate financial services. I think so far I'm going to open a Roth and invest in three vanguard index funds. Contribute automatic invest plans monthly.

I'll also keep my individual account open with my money market fund. As for my current securities I'll either sell them all once they hit their highs again and take the cash and keep putting in to O which pays a monthly dividend. Or I'll keep them and after AIP contributions for roth, if I can afford to continue buying more shares into my individual account I'll do that.

I'll also keep my individual account open with my money market fund. As for my current securities I'll either sell them all once they hit their highs again and take the cash and keep putting in to O which pays a monthly dividend. Or I'll keep them and after AIP contributions for roth, if I can afford to continue buying more shares into my individual account I'll do that.

As for my current securities I'll either sell them all once they hit their highs again

Trying to wait for stocks to recover before selling is a common thing that people want to do because of the psychological phenomenon of loss aversion, but it's a bad move from a tax perspective.

If you want to get out of individual stocks, you are better off selling them now (provided you buy into the index funds immediately). The fact that the entire market is down now is a good thing for anyone who wants to exit a position, because you will lose less money to capital gain tax when you sell your current stocks. You may even get a capital loss that you can deduct on your taxes next year.

Trying to wait for stocks to recover before selling is a common thing that people want to do because of the psychological phenomenon of loss aversion, but it's a bad move from a tax perspective.

If you want to get out of individual stocks, you are better off selling them now (provided you buy into the index funds immediately). The fact that the entire market is down now is a good thing for anyone who wants to exit a position, because you will lose less money to capital gain tax when you sell your current stocks. You may even get a capital loss that you can deduct on your taxes next year.

What about us who live in country with no capital gain tax, is it worth waiting for some price recovery or just sale at loss.

What about us who live in country with no capital gain tax, is it worth waiting for some price recovery or just sale at loss.

In most cases, no. The only case where it makes sense to wait is if you have strong reason to believe that your current stocks will significantly outperform the index fund you want to replace it with over the short term.

Being able to accurately predict short-term performance is incredibly difficult unless you have insider information. Even people who advocate stock picking are usually looking for long-term outperformance, not short-term.

Looking at the OP suggestion for Vanguard Total Market Fund, which I'm assuming is symbol VTSM, it hasn't performed well historically compared to say, a fund im looking at: PBCKX or even TRBCX? Yes higher expense ratio, but just wanted your guys opinions?

If I recall, that ticker is probably VTI, not VTSM.

In any case, this thread is based around passive investment in the entire market which is why ETFs such as VTI are recommended. I did take a cursory look at the 5-year charts between PBCKX and VTI and they look very similar to me. I can't say it's a bad idea to focus on blue chips, it just depends on what you want your exposure to volatility to be.

We target the simplest investing plan possible which is put your money into the entire market at the lowest expense possible and just let it go. It's recommended that you literally write down your investing plan and what your "rules" are and then follow those rules to the letter. The more rules you have, and the more reactionary you are, the likelier it is that you will lose money.

So that's my perspective. Keep it simple, don't make a lot of changes, don't be reactionary.

In any case, this thread is based around passive investment in the entire market which is why ETFs such as VTI are recommended. I did take a cursory look at the 5-year charts between PBCKX and VTI and they look very similar to me. I can't say it's a bad idea to focus on blue chips, it just depends on what you want your exposure to volatility to be.

We target the simplest investing plan possible which is put your money into the entire market at the lowest expense possible and just let it go. It's recommended that you literally write down your investing plan and what your "rules" are and then follow those rules to the letter. The more rules you have, and the more reactionary you are, the likelier it is that you will lose money.

So that's my perspective. Keep it simple, don't make a lot of changes, don't be reactionary.

Thanks for that. My Roth was approved, and most likely I'll put $6k in it to hit 2019s max contribution. I do want three index/mutual funds to choose Just to keep it simple. A large cap fund, and the other two midcap, and maybe some dividend index fund.

Quick thing to add about HSA's. My employer uses HealthEquity as the HSA provider but I simply do a transfer of assets transaction a few times a year to move my HSA money over to Fidelity so I can get access to all of their investment options. Little bit of hassle but not too bad.

Ugh min. Investment amounts for vtsax and vsmax are $3,000 each. If I'm hitting my max contributions for Roth at $6k, that kinda rules out the vanguard index funds. Gonna have to find ETF equivalents right?

edit-and now if I choose ETFs my company charges $25 trade fees per purchase. Sigh :(.

edit-and now if I choose ETFs my company charges $25 trade fees per purchase. Sigh :(.

Last edited:

So I was able to buy the vanguard index funds. No Initial investment amount if we hold their funds. Did $6k prior year:

-$3600 in VTSAX

-$1800 in VSMAX

-$600 in VTIAX

Wish me luck guys. Next paycheck will start contributing for 2020.

-$3600 in VTSAX

-$1800 in VSMAX

-$600 in VTIAX

Wish me luck guys. Next paycheck will start contributing for 2020.

👍🏻Gotta start somewhere!So I was able to buy the vanguard index funds. No Initial investment amount if we hold their funds. Did $6k prior year:

-$3600 in VTSAX

-$1800 in VSMAX

-$600 in VTIAX

Wish me luck guys. Next paycheck will start contributing for 2020.

Our budgeting has always been start with a savings goal, save that amount, do whatever with the rest.

It allows us to eat out mostly as much as we want, travel a bunch, get massages etc and also save a nice amount for retirement. I've never really cared about tracking all the little spending.

But now that we've been on lockdown for almost a month, I'm starting to slightly regret that. We are saving so much money right now. Like, so much. I've tripled my normal contributions to our long-term savings in the last month. Some of that is because my wife's bonus came through and we got the stimulus, but I'm pretty sure we have saved like $2k since stay at home was mandated. Grocery bill went up, almost everything else dropped to near zero.

This won't spur me to try to rein in my wife's spending when this is all over (she's the one that makes the big money anyway, she deserves her luxuries who am i to question it when we are easily meeting our savings goals) but man it's surprising how much we could save if we went crazy with it.

It allows us to eat out mostly as much as we want, travel a bunch, get massages etc and also save a nice amount for retirement. I've never really cared about tracking all the little spending.

But now that we've been on lockdown for almost a month, I'm starting to slightly regret that. We are saving so much money right now. Like, so much. I've tripled my normal contributions to our long-term savings in the last month. Some of that is because my wife's bonus came through and we got the stimulus, but I'm pretty sure we have saved like $2k since stay at home was mandated. Grocery bill went up, almost everything else dropped to near zero.

This won't spur me to try to rein in my wife's spending when this is all over (she's the one that makes the big money anyway, she deserves her luxuries who am i to question it when we are easily meeting our savings goals) but man it's surprising how much we could save if we went crazy with it.

Our budgeting has always been start with a savings goal, save that amount, do whatever with the rest.

It allows us to eat out mostly as much as we want, travel a bunch, get massages etc and also save a nice amount for retirement. I've never really cared about tracking all the little spending.

But now that we've been on lockdown for almost a month, I'm starting to slightly regret that. We are saving so much money right now. Like, so much. I've tripled my normal contributions to our long-term savings in the last month. Some of that is because my wife's bonus came through and we got the stimulus, but I'm pretty sure we have saved like $2k since stay at home was mandated. Grocery bill went up, almost everything else dropped to near zero.

This won't spur me to try to rein in my wife's spending when this is all over (she's the one that makes the big money anyway, she deserves her luxuries who am i to question it when we are easily meeting our savings goals) but man it's surprising how much we could save if we went crazy with it.

The economy sure is going to come roaring back with this kind of thinking...

Right guys? Right???

The economy sure is going to come roaring back with this kind of thinking...

Right guys? Right???

This thread is about saving for retirement, maybe save your shitposting for elsewhere?

This thread is about saving for retirement, maybe save your shitposting for elsewhere?

Really... this was just a minor joke...

I'm sure you've some commentary on how there are some STILL some who believe businesses need to open so that the stock market can begin "V shaped" comeback. I'm surprised at this reposne considering all my posts in this thread have been relevant and pushed discussion further when there hasn't much activity.

The economy sure is going to come roaring back with this kind of thinking...

Right guys? Right???

The problem with increased spending won't be our new found ability to save ungodly amounts of money if we live like hermits, it will be our willingness to expose ourselves to the outside world in old ways.

If we are confident that we can safely go out to eat, or go to busy hiking trails, go to movie theaters etc then we're certainly will. I'm not a FIRE person, I'm not going to live as frugal a life as possible just to retire 10-15 years early. But we won't resume our normal spending until things seem safe to do so.

Many though will likely resume immediately when the people in government they listen to say it's ok. As long as they still have jobs of course.

Yeah it's good that you've taken this approach. It's crazy because I didn't even realize the savings rate I had, but as I learned more about FIRE, I eventually came to financial blog and calculated mine based on that information. You both should see what yours is and it will give you a rough idea on how many years until retirement.The problem with increased spending won't be our new found ability to save ungodly amounts of money if we live like hermits, it will be our willingness to expose ourselves to the outside world in old ways.

If we are confident that we can safely go out to eat, or go to busy hiking trails, go to movie theaters etc then we're certainly will. I'm not a FIRE person, I'm not going to live as frugal a life as possible just to retire 10-15 years early. But we won't resume our normal spending until things seem safe to do so.

Many though will likely resume immediately when the people in government they listen to say it's ok. As long as they still have jobs of course.

EDIT: https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

reKon : that's an interesting link and it's definitely something for everyone to think about. That said, I'm not really a FIRE type, so I tend to raise an eyebrow at lines such as "If you save a reasonable percentage of your take-home pay, like 50%". I'd argue that if you're fortunate enough to be able to save 50% of your net income then you're very much in the minority.

In terms of the economy at large, I suspect that a lot of people will be tightening their belts right now, whether that's because of reduced income or reduced opportunity to spend (or both!). The big question is what happens when things get back to normal. I'd imagine that the majority will resume their spending habits, and there might even be an increase on pre-lockdown spending for a short while, but at the same time there will be plenty of people who will either not be in position to spend (having lost their jobs or a substantial chunk of their income) or who will choose to hang on to their money - and given that there's going to be prolonged uncertainty about the coronavirus situation and the economy itself, I can see people being much more cautious, at least in the short term.

In terms of the economy at large, I suspect that a lot of people will be tightening their belts right now, whether that's because of reduced income or reduced opportunity to spend (or both!). The big question is what happens when things get back to normal. I'd imagine that the majority will resume their spending habits, and there might even be an increase on pre-lockdown spending for a short while, but at the same time there will be plenty of people who will either not be in position to spend (having lost their jobs or a substantial chunk of their income) or who will choose to hang on to their money - and given that there's going to be prolonged uncertainty about the coronavirus situation and the economy itself, I can see people being much more cautious, at least in the short term.