Ray Dalio said in February said before that "cash is trash" and that most of your money should be in the market anyway. For real, is there any other place to put it? Aside from a HYSA, you're just slowly losing money to inflation sticking it under your mattress. Personally I think the best thing would be to have your money in the market, and to sell options against your positions to collect premium (sweet, sweet, premium). However that requires knowledge of options or else significant loss could occur.

Current position:

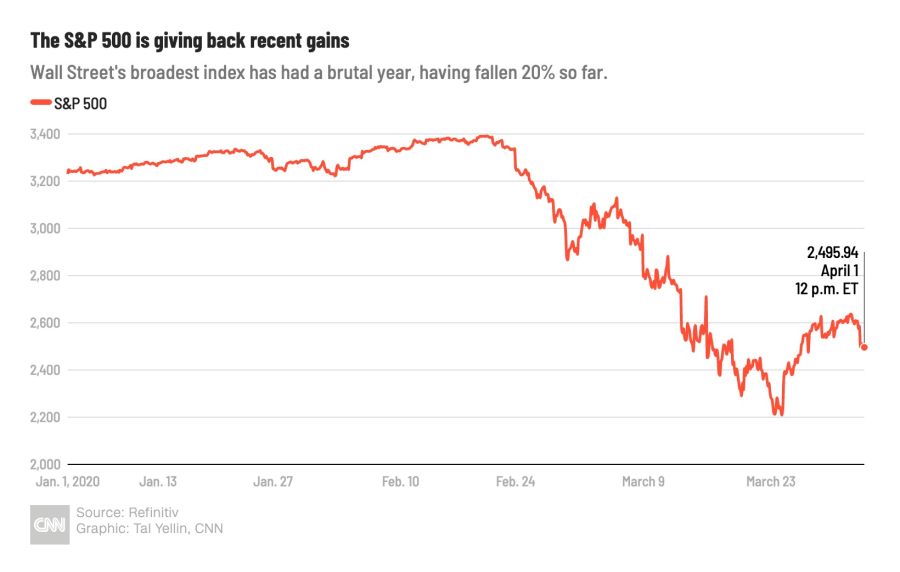

To note, this looks like a huge gain, but I'm still about $2.3k from break even on all those spreads I bought awhile ago. At least I'm relatively protected from theta decay, but I'd like SPY to dump to 220 sooner rather than later. However, the price war between Russia and Saudi Arabia might end soon, as the two sides are about to go into talks. If they reach an agreement, oil prices will go back up, and both sides have good reasons to reach an agreement. That means oil will go back up, and USO will start printing.

The play:

- USO bull call spreads exp 1/2021, 7c/12c. I don't think USO is gonna shoot to 40, but it will take a nice leap once those shale drillers in the states get back to business.

- SPY bear put spreads at open, exp 5/15 246p/236p. I think this dead cat bounce is about to be over, so I'm trying to ride the wave down w/ staggered spreads until my prior spread dump finally reaches max profit. I just hope it can do that before theta comes for my booty.

- Also might look into some Biotech stuff, and anything that's getting near earnings. Why not shoot for the moon.