-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Stock Market Watch |OT| I've stocked up on market watches, what now?

- Thread starter Mr.Awesome

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Oh look at that... Buffett dumped just before a huge earnings warning... totally luck I'm sure... uh huh.

It's news like this that make me feel we have not yet hit the bottom.

That is my feeling as well.

They are keeping the market artificially alive but that can't work forever, can it?

They are keeping the market artificially alive but that can't work forever, can it?

Oh look at that... Buffett dumped just before a huge earnings warning... totally luck I'm sure... uh huh.

TBH, Delta being risky as fuck isn't actually a hard call.

you and me both lol

Oh look at that... Buffett dumped just before a huge earnings warning... totally luck I'm sure... uh huh.

Not to say there's no insider trading but it's also not exactly rocket science to know it's probably a good idea to dump airline stock as fast as possible right now.

Lmao. I think someone here mentioned it would be sweet if DAL dropped to $10 a share and I'm thinking it might just go that low even if things get really bad for it.

crazy to buy/hold airlines and cruises in the his climate

this isn't some brilliant move by buffet

this isn't some brilliant move by buffet

Lmao, that's the hardest I've laughed in weeks.

glad you enjoyed it, saw this this morning and nearly cracked up during a conference call.

I have like $500 In DAL that I bought in at around $22. I'll ride it out or lose it at that price.

Lmao. I think someone here mentioned it would be sweet if DAL dropped to $10 a share and I'm thinking it might just go that low even if things get really bad for it.

Lmao. I think someone here mentioned it would be sweet if DAL dropped to $10 a share and I'm thinking it might just go that low even if things get really bad for it.

That was me!

Although even at $10, I would need some assurance of another govt bailout or them being bought by another airline.

That was me!

Although even at $10, I would need some assurance of another govt bailout or them being bought by another airline.

I just can't see Delta actually collapsing for good. I mean, I'm not gonna gamble on it but...

I think most airlines are risky right now because there's no reason to really keep any one in particular with there being so much competition. The only reason I can see Delta getting a bailout (in addition to anything already passed) is because it's located in Georgia which is a Republican state.

I don't think cruiselines are that risky. They probably won't be operating for a while, but I can't imagine they're at risk of going bankrupt. Just waiting for their stock to drop lower.

I don't think cruiselines are that risky. They probably won't be operating for a while, but I can't imagine they're at risk of going bankrupt. Just waiting for their stock to drop lower.

I went to marketwatch

GME Stock Price | GameStop Corp. Cl A Stock Quote (U.S.: NYSE) | MarketWatch

GME | Complete GameStop Corp. Cl A stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.www.marketwatch.com

it says the short interest is 110% lol. that can't be right.

High Short Interest Stocks

www.highshortinterest.com

The problem with that is, a company can be acquired and the investors can still be all but wiped out. Bear Stearns e.g., it was $30 on the Friday iirc, and $2 on Monday morning which was the agreed price for the stock swap deal.That was me!

Although even at $10, I would need some assurance of another govt bailout or them being bought by another airline.

Lots of naked shorts.yep lol that cant be right? Even ownership is shorting it?High Short Interest Stocks

www.highshortinterest.com

I don't know why Buffet dumped DAL but I'm not in the business of betting against Buffet.

Guys, he still owns nearly 60 million shares still.

He dumps 15M, at price X, peoples freak out and sell, price of DAL drops down under X, he buys back his shares at a bargain and makes even more cash in the future.

This is fucking Buffet, he's not losing billions without a strategy, this motherfucker has so much influence, he's manipulating the market.

He hasn't scared me off of DAL. I still think my investment will double in 5 or 6 years. Just wish I waited 8 hours. :PGuys, he still owns nearly 60 million shares still.

He dumps 15M, at price X, peoples freak out and sell, price of DAL drops down under X, he buys back his shares at a bargain and makes even more cash in the future.

This is fucking Buffet, he's not losing billions without a strategy, this motherfucker has so much influence, he's manipulating the market.

So I assume Monday should be pretty red.

But I was wrong last time.

its going to rollercoaster.

Maybe slowly downwards though.

Bingo. This is basic billionaire market strategy. Anyone buying into the smoke and mirrors the market manipulators are currently flashing in order to make bank on a collapsing economy, is in for a very rude (and expensive) awakening soon.Guys, he still owns nearly 60 million shares still.

He dumps 15M, at price X, peoples freak out and sell, price of DAL drops down under X, he buys back his shares at a bargain and makes even more cash in the future.

This is fucking Buffet, he's not losing billions without a strategy, this motherfucker has so much influence, he's manipulating the market.

Maybe if it was them alone. They wouldn't be the first legacy carrier to fail. But if the industry itself is collapsing, then they will be more aggressively bailed out.

Socialiam for the wealthy.Maybe if it was them alone. They wouldn't be the first legacy carrier to fail. But if the industry itself is collapsing, then they will be more aggressively bailed out.

Apparently Trump and his cronies sold out of the position they took ahead of Trump's tweet about oil a couple of days ago.

Even at the best of times, airline stock is avoided by many investors. Many airline companies have failed. They have very high operating costs. Profits are directly tied to fuel prices. Very susceptible to events like 9-11 and now collapsed by coved.

Airline stock fluctuates wildly and are so risky that they need to be closely monitored. Most financial advisors usually just say... avoid.

Airline stock fluctuates wildly and are so risky that they need to be closely monitored. Most financial advisors usually just say... avoid.

What's the saying? Socialize the losses, privatize the profits?

As did anyone with a blue's clue.Apparently Trump and his cronies sold out of the position they took ahead of Trump's tweet about oil a couple of days ago.

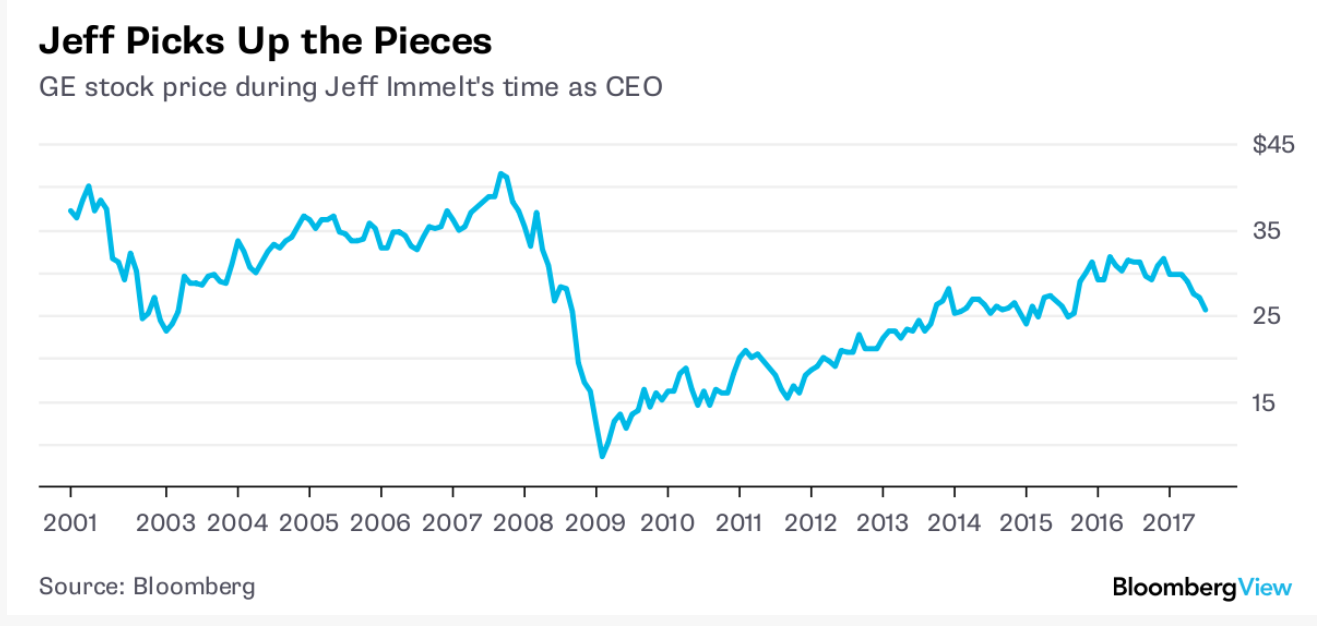

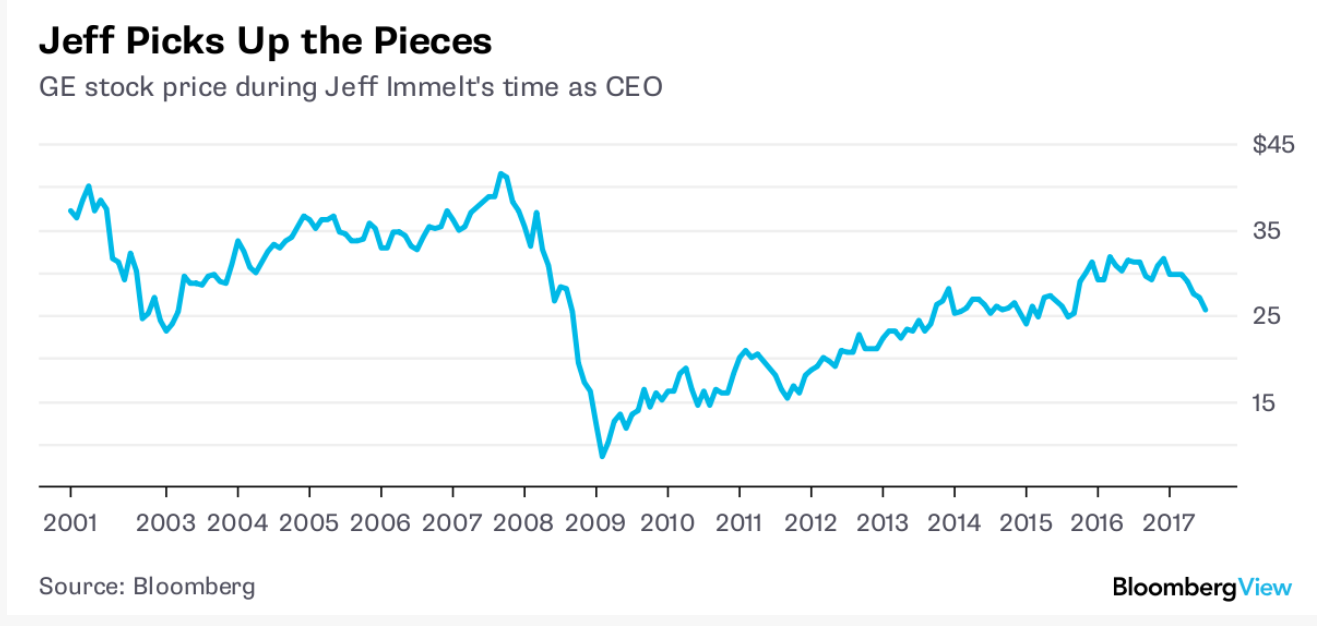

Just because DAL could be bailed out doesn't mean its stock price will be preserved. This is why I don't like messing with Boeing either. I think GE is the illustrative example here.

For the record I do think bailouts of DAL/BA are likely, but I don't know if that makes them good investments or trading opportunities.

For the record I do think bailouts of DAL/BA are likely, but I don't know if that makes them good investments or trading opportunities.

There is always a saying that the stock market doesn't like being away from it's 20 period moving average too long, and you can see the spy magnet back to it on the latest rally. One of the reasons I was looking for a bear market reversal rally a couple Sundays ago, because it was far away from it's 20 day simple moving average.

However, now that the market is back to the 20 day simple moving average , it is getting pushed down by said 20 day SMA. The goal is to have this line curl upwards and act as support as you can see on the rally before the plunge. Will likely take awhile to accomplish. Bear markets aren't typically something that turn right away, but happen over time, so I'm not expecting the quick V recover. Bear market rallies? Sure. But the all clear is likely a fair clip away because we are only 6 weeks into this bear market. Sp500 2350 or 2400, could be areas where the market tries to flatten out this curve to go sideways, or go into a sideways wave. Get a rally going to go into a choppy wave up and down. Which wouldn't be the worst thing in the world if we went sideways between like 2350 and 2800 for the next year or two to get out of this bear market. Or just get pushed down slowly to 2000 and then move between 2000 and 2800. Better than completely crashing. Though I suppose depending on how much cash you are sitting on you might want the market to keep going down.

The only way I can see the market truly V is that the economic damage from Covid 19 is minimal, and productivity goes back to normal by June. However, I believe this is a tall task.

However, now that the market is back to the 20 day simple moving average , it is getting pushed down by said 20 day SMA. The goal is to have this line curl upwards and act as support as you can see on the rally before the plunge. Will likely take awhile to accomplish. Bear markets aren't typically something that turn right away, but happen over time, so I'm not expecting the quick V recover. Bear market rallies? Sure. But the all clear is likely a fair clip away because we are only 6 weeks into this bear market. Sp500 2350 or 2400, could be areas where the market tries to flatten out this curve to go sideways, or go into a sideways wave. Get a rally going to go into a choppy wave up and down. Which wouldn't be the worst thing in the world if we went sideways between like 2350 and 2800 for the next year or two to get out of this bear market. Or just get pushed down slowly to 2000 and then move between 2000 and 2800. Better than completely crashing. Though I suppose depending on how much cash you are sitting on you might want the market to keep going down.

The only way I can see the market truly V is that the economic damage from Covid 19 is minimal, and productivity goes back to normal by June. However, I believe this is a tall task.

Last edited:

I am thinking to put some money split evenly across Delta, United, and American Airlines. My rationale being that the stocks are very low right now and this is filling a need that will continue to exist and cannot be replaced.

Good idea, bad idea? What is the risk of these going out of business? Should I include Southwest?

Good idea, bad idea? What is the risk of these going out of business? Should I include Southwest?

if this is money you're perfectly willing to lose, sure, go with it, but generally speaking it's not a good idea to go all in on one thing. if you have enough to invest in multiple airlines, maybe pick one and invest rest in something else?I am thinking to put some money split evenly across Delta, United, and American Airlines. My rationale being that the stocks are very low right now and this is filling a need that will continue to exist and cannot be replaced.

Good idea, bad idea? What is the risk of these going out of business? Should I include Southwest?

We don't know. They've never gone this far before.They are keeping the market artificially alive but that can't work forever, can it?

Why would you place a bet on an entire industry like that? Seems like a better idea to put some money on the strongest airline (Delta) and then place other bets elsewhere. Banks have also been pummeled. Starbucks has been crushed. Disney is down a lot.I am thinking to put some money split evenly across Delta, United, and American Airlines. My rationale being that the stocks are very low right now and this is filling a need that will continue to exist and cannot be replaced.

Good idea, bad idea? What is the risk of these going out of business? Should I include Southwest?

Personally I recommend most people be very careful buying individual companies at a time like this though. It's far safer to buy the S&P and just place a bet on the U.S economy making a big comeback in 2021 and 2022.

Why would you place a bet on an entire industry like that? Seems like a better idea to put some money on the strongest airline (Delta) and then place other bets elsewhere. Banks have also been pummeled. Starbucks has been crushed. Disney is down a lot.

Personally I recommend most people be very careful buying individual companies at a time like this though. It's far safer to buy the S&P and just place a bet on the U.S economy making a big comeback in 2021 and 2022.

Thanks for the thoughts.

I am also planning to separately put money in the S&P500, after it goes down some more. Allow me to give my rationale for why I am looking at a modest airline investment, which may be total bullshit and if so do call me out on it. The airline industry stocks are dirt cheap right now, having decreased more on a percent basis than 95% of other major firms (down to 1/3 to 1/4 of peak value). Further air travel is an integral economic activity, and thus it can be said that within reason that the industry as a whole will recover eventually (which cannot be said of the other dirt cheap stocks such as movie theater chains and cruise lines). The only challenge is if a particular company goes under completely or stuck in a bailout with unfavorable terms for shareholders. This is why I would propose to split my money in this sector across the big 3; i.e., if I can get 2+ fold return long-term on 2/3 it would still make sense even if 1/3 goes down the tubes. Again, if my thinking is flawed here let me know. I won't invest until Wednesday.

Your basic logic is not flawed. The airlines aren't going away. I just don't see a point in betting on three of them. I'd rather bet on the strongest airline, and then place bets in other sectors, like Starbucks and Disney. The idea of placing too many eggs in a single basket just doesn't seem like the best idea regardless of how critical that industry is.Thanks for the thoughts.

I am also planning to separately put money in the S&P500, after it goes down some more. Allow me to give my rationale for why I am looking at a modest airline investment, which may be total bullshit and if so do call me out on it. The airline industry stocks are dirt cheap right now, having decreased more on a percent basis than 95% of other major firms (down to 1/3 to 1/4 of peak value). Further air travel is an integral economic activity, and thus it can be said that within reason that the industry as a whole will recover eventually (which cannot be said of the other dirt cheap stocks such as movie theater chains and cruise lines). The only challenge is if a particular company goes under completely or stuck in a bailout with unfavorable terms for shareholders. This is why I would propose to split my money in this sector across the big 3; i.e., if I can get 2+ fold return long-term on 2/3 it would still make sense even if 1/3 goes down the tubes. Again, if my thinking is flawed here let me know. I won't invest until Wednesday.

Investing like this is one of those things where everyone will have their own strategies though.

The airplanes won't go away, but the equity certainly can.Thanks for the thoughts.

I am also planning to separately put money in the S&P500, after it goes down some more. Allow me to give my rationale for why I am looking at a modest airline investment, which may be total bullshit and if so do call me out on it. The airline industry stocks are dirt cheap right now, having decreased more on a percent basis than 95% of other major firms (down to 1/3 to 1/4 of peak value). Further air travel is an integral economic activity, and thus it can be said that within reason that the industry as a whole will recover eventually (which cannot be said of the other dirt cheap stocks such as movie theater chains and cruise lines). The only challenge is if a particular company goes under completely or stuck in a bailout with unfavorable terms for shareholders. This is why I would propose to split my money in this sector across the big 3; i.e., if I can get 2+ fold return long-term on 2/3 it would still make sense even if 1/3 goes down the tubes. Again, if my thinking is flawed here let me know. I won't invest until Wednesday.

I'm annoyed that I never got my Tesla $350ish shares. Based on everything that's happened thus far, I can't see them hitting that low.

For Disney my target was $75 weeks ago. Maybe I can hope for $80 and below in the future?

I'm waiting for another crash and I have no idea why its been up beyond pure manipulation

I'm waiting for another crash and I have no idea why its been up beyond pure manipulation

There are roughly 450 MILLION trades just on the Dow each day. No organization is large enough to manipulate that. Yes, the Fed and Congress are pumping liquidity in the market. That's what they're supposed to do and anyone shorting the market should know it will continue.

- Status

- Not open for further replies.