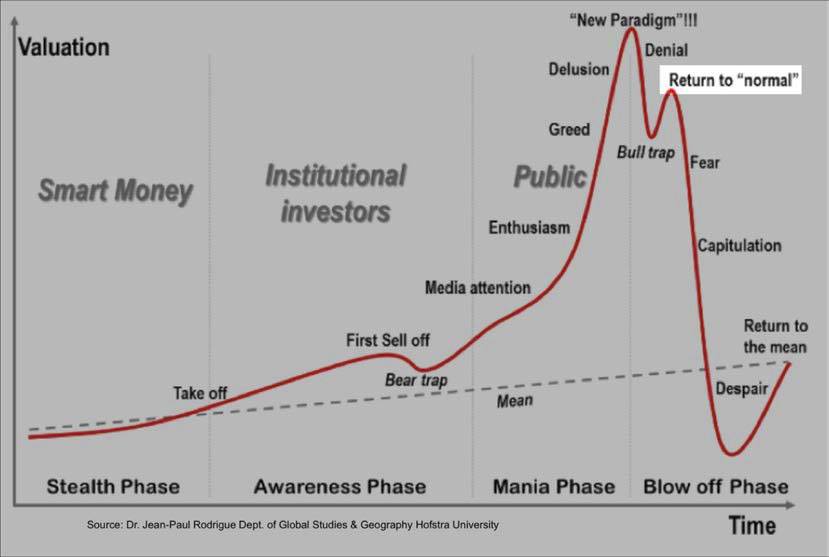

Remember, we are in the hope phase with this rally. This is the "we will look forward past covid 19" moment. Which is true as I believe the USA economy will get past it. But I expect the conversation to change to "How much damage has covid 19 done to the economy", because I don't believe we will get the V economic recovery some are predicting. Covid 19 will still be with us even if it dissipates in seriousness over the summer, and this will likely lead to people not going out as often and spending money. Plus, the fallout from this shut down is likely to cause usa residents to save more rather than spend as freely as before. In addition, companies that take assistance likely won't be able to issue buybacks, and this is a driver for increasing share price. Finally, companies are withdrawing earnings so there is almost no case to base the market on any type of fundamental analysis at the moment. I always try to look at both scenarios for the market, good and bad, but I believe we have a long way to go before getting the all clear moment people are looking for.

Last edited: