Broker/Dealer

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Threadmarks

View all 9 threadmarks

Reader mode

Reader mode

Recent threadmarks

$70! Trading halted on various platforms Opening above $100 on 1/25 Flirting with 300 in premarket on 1/27 Please move general stock talk to Stock Market Era 1/27 close at 347; indraday high of 380 Biden moving at record speed; Unity incoming 1/28 - closed at 193.60Broker/Dealer I assume, basically his company's lawyers.

If he did things by the book and didn't publicize and also notified his firm and got trading clearance, they would have to fight along with him.

Agreed, I was making the assumption he wasn't doing any of that.

That said I'm kinda surprised he did that as an RIA.

Yeah, this was an extremely fucking stupid thing to do in your free time without telling your employer. He is (maybe) lucky he made enough money to not worry about needing employment for a while. I've seen people engage in similar stupid activity and make nothing on it.

FINRA can't actually enforce the fine if you drop your registration, but I would presume if he is doing something real real bad the SEC and states will get involved and they can come after you much harder.

From a mere two seconds of Google, his employer was life insurance? So presumably him trading GME outside of work would be mostly about the ethics, I mean he probably wasn't recommending it to clients and front-running it?It depends on what he did, what he can prove and how good his lawyers are.

If he was front-running ahead of posting Youtube videos/posting to Reddit I would want a disgorgement of 100% of all trading profits and a 5 year ban. I am sure they will settle for a large fine and a 1-2 year ban.

If his job as Mass had anything to do with customer trades or he was accessing firm positions or customer positions in GME or the open book.... probably worse than that. If he did nothing other than fail to disclose an account and outside business activity it'll likely be a 7 figure fine and a 6 month ban from the industry when I'm sure he'll take.

From a mere two seconds of Google, his employer was life insurance? So presumably him trading GME outside of work would be mostly about the ethics, I mean he probably wasn't recommending it to clients and front-running it?

MassMutual also operates mutual funds and retirement services. He was a financial advisor so presumably client facing making recommendations to customers.

The reasoning was GameStop was super shorted and undervalued and had a chance to go up, it was always about the money. The little guy vs Wall Street narrative was never really a good reason considering "Wall Street" isn't a singular entity and there were plenty of parties on the winning side. Ultimately the losers are the ones that bought into all that and held on for the cause (among many others just looking for a quick buck).It is sad what it came down to. The reasoning was sound enough. Who didn't want to take a crack at making money and hurting the people on Wallsteet that have been fucking over the common man for decades. I guess hopes and dreams do die.

Well if you assume it'll continue to go down but still like the stock (there's some arguable reasons), you could sell now and buy back in for more shares. And not entirely sure on this, but I think doing so would also let you claim losses for tax purposes. If you just keep it in there it's just isolated from that afaik, i.e. you don't have realized gains/losses until you sell the stock.Yeah, its true that its better to lose e.g $80 instead of $90, indeed. And sure, i'm not trying to burn any money just for the fun of it, i could have been more clear on that :) The main reason why i'm keeping them is just in case something unexpected happens. I kinda "panicked" last week when i bought one stock at $97 and saw it drop down to the $80-range, and i ended up selling it for $93 some hours later. Not a big loss, but if i had hold it a big longer, i would have had a nice profit instead.

If i lose e.g 70, 80 or 90 percent of that $100 investment, it doesnt make that much of a difference since i'm already at a big loss, so i dont mind waiting a bit and see what will happen. Maybe GameStop manages to be successful for the next few years and increase the stock price up again (nowhere close to $200+ though), then i will minimize the loss. I'm not having any high expecations that the stock price will increase noticeably again, but only time will tell =)

First off, yeah just get ETFs. Disney might even be in some of them!Not gonna lie man. Just as green as you (I think?) about stocks. There is a subreddit called stocks and there was a long DD about Disney.

Their earning are in 6 days. I mean sure we 'missed' the boat because when covid started it was 128.. But if one company comes to mind for me it is Disney..

Parks open, their Disney+ just got bigger with the launch of Star content. This and next year they will have a LOT of original content from Marvel, Star Wars. And that is without even the cinema movies which will come at some point..

For me it seems like Apple.. Did you miss the boat when it keeps rising? I think Disney has the right mind for years to come at least..

But yeah that is what I want to find out with reading and properly educating myself this time instead of 'yolo stoinkz'. So maybe wait for the earning, see what it does to the market and then maybe buy on a dip?

anotherdoof yeah my mate told me today of ETF :) that certainly is a possibility for me but that also is totally new ground and kind of exciting to read about and what is good to invest in from the Netherlands point of view :) So hope to do some good reading on it coming weeks.. It is more exciting than putting it on the bank account haha

But anyway for Disney itself, I got them some time ago just cause some loose criteria of them probably not going away and roughly, not being run by idiots and knowing their own worth. They know how to milk their IP for all its worth and not devalue themselves, and I feel like they've proven themselves to be pretty agile in recent years. I don't expect huge returns but I don't really have major worries either, speaking over super long term at least. Like even shit went bad with them I'd still expect them to recover eventually.

Oh and yeah like someone said, don't buy based on news/earnings. Stock tends to be volatile and go stupid for a while. It can be a chance to buy dips though. Ultimately in the long term it generally just averages out whenever you buy so timing only matters so much other than big ass major swings.

Same energy indeed (...assuming we're thinking of the same thing)

From a mere two seconds of Google, his employer was life insurance? So presumably him trading GME outside of work would be mostly about the ethics, I mean he probably wasn't recommending it to clients and front-running it?

Mass Mutual owns a FINRA registered broker/dealer, lots of insurance companies do. I have no idea what kind of business they engage in and no idea if they have an institutional customer base or not and we don't know what his job entailed.

It is an ethical violation, but also if he was saying "buy GME" on Reddit and Youtube *after* he placed purchase orders its front-running investment advice which is very extremely clearly forbidden. As an RIA I would make the case that he was operating an outside business activity as an unregistered investment advisor, and given that he has a CFA as well as being registered as an RIA he would clearly know the rules around giving that kind of advice. Unlike a "guy off the street" he could not make the case that he didn't know this activity was potential wrong. He has a fiduciary obligation to his clients, meaning he has to literally put their best interest first.

He is *probably* a relatively retail facing person at Mass Mutual, as most of the CFAs I know work exclusively with retail customers or maybe do due diligence for a firms back office before they offer an investment to retail customers. Institutional investors won't care about that designation. The CFA is actually bad for him in this case, because it means he has taken on even more knowledge about the ethics and legality of what he was doing than just a typical RIA.

The problem for him is you could make the case that his *outside* investment advice on Youtube and Reddit constituted activity that would fall under the perview of Mass Mutual as an outside business activity. His B/D failed to do so, or he failed to disclose the activity. I was never allowed to buy or sell stocks in individual companies without first getting permission from a compliance officer. Either he did not disclose this trading activity to his B/D or they failed to ask the right questions. Because trading stock on a company you are giving investment advice to as part of an OBA is... not great.

I'd have to go through all his youtube videos, Reddit posts and his trading activity. But if he said "the short squeeze is working, the price should peak on Friday" and he just bought a bunch of shares, I would argue that he should *at the least* adjust his price per share to the same as it was when the youtube video was posted. At the worst, I would want him to disgorge any profits he made by trading in contradiction to his advice or ahead of giving advice. If he traded ahead of advice or traded contrary to advice its *extremely* easy to prove. Like, some of the easiest activity to detect.

I'd also want to grab all of his work emails, and if he was using Reddit/Youtube or anything else in conjunction with the Outside Business Activity, I would want any and all DMs related to that business. I think it would be pretty easy to get my hands on.

There is a reason stock analysts aren't allowed to buy and sell shares in the companies that provide advice on. Like, Pachter aint out there buying Nintendo stock right before he gives advice on the target price of Nintendo.

Again, its possible he didn't do any of the really bad stuff, but even the less bad stuff is pretty not good.

Last edited:

Thanks :) Will educate myself on the ETF but really appreciate all the input from other people!The reasoning was GameStop was super shorted and undervalued and had a chance to go up, it was always about the money. The little guy vs Wall Street narrative was never really a good reason considering "Wall Street" isn't a singular entity and there were plenty of parties on the winning side. Ultimately the losers are the ones that bought into all that and held on for the cause (among many others just looking for a quick buck).

Well if you assume it'll continue to go down but still like the stock (there's some arguable reasons), you could sell now and buy back in for more shares. And not entirely sure on this, but I think doing so would also let you claim losses for tax purposes. If you just keep it in there it's just isolated from that afaik, i.e. you don't have realized gains/losses until you sell the stock.

First off, yeah just get ETFs. Disney might even be in some of them!

But anyway for Disney itself, I got them some time ago just cause some loose criteria of them probably not going away and roughly, not being run by idiots and knowing their own worth. They know how to milk their IP for all its worth and not devalue themselves, and I feel like they've proven themselves to be pretty agile in recent years. I don't expect huge returns but I don't really have major worries either, speaking over super long term at least. Like even shit went bad with them I'd still expect them to recover eventually.

Oh and yeah like someone said, don't buy based on news/earnings. Stock tends to be volatile and go stupid for a while. It can be a chance to buy dips though. Ultimately in the long term it generally just averages out whenever you buy so timing only matters so much other than big ass major swings.

Same energy indeed (...assuming we're thinking of the same thing)

Yep, thanks for the info.Mass Mutual owns a FINRA registered broker/dealer, lots of insurance companies do. I have no idea what kind of business they engage in and no idea if they have an institutional customer base or not and we don't know what his job entailed.

It is an ethical violation, but also if he was saying "buy GME" on Reddit and Youtube *after* he placed purchase orders its front-running investment advice which is very extremely clearly forbidden. As an RIA I would make the case that he was operating an outside business activity as an unregistered investment advisor, and given that he has a CFA as well as being registered as an RIA he would clearly know the rules around giving that kind of advice. Unlike a "guy off the street" he could not make the case that he didn't know this activity was potential wrong. He has a fiduciary obligation to his clients, meaning he has to literally put their best interest first.

He is *probably* a relatively retail facing person at Mass Mutual, as most of the CFAs I know work exclusively with retail customers or maybe do due diligence for a firms back office before they offer an investment to retail customers. Institutional investors won't care about that designation.

The problem for him is you could make the case that his *outside* investment advice on Youtube and Reddit constituted activity that would fall under the perview of Mass Mutual who failed to do so, or he failed to disclose the activity.

I'd have to go through all his youtube videos, Reddit posts and his trading activity. But if he said "the short squeeze is working, the price should peak on Friday" and he just bought a bunch of shares, I would argue that he should *at the least* adjust his price per share to the same as it was when the youtube video was posted. At the worst, I would want him to disgorge any profits he made by trading in contradiction to his advice or ahead of giving advice.

There is a reason stock analysts aren't allowed to buy and sell shares in the companies that provide advice on. Like, Pachter aint out there buying Nintendo stock right before he gives advice on the target price of Nintendo.

And that isn't even getting into the possible pump n dump story. His daily posts about how much money he was making were clearly galvanizing on social media, which poured gasoline on the fire and enriched himself. I'm assuming that will ultimately be called free speech, but they may still try to go after him.

Yep, thanks for the info.

And that isn't even getting into the possible pump n dump story. His daily posts about how much money he was making were clearly galvanizing on social media, which poured gasoline on the fire and enriched himself. I'm assuming that will ultimately be called free speech, but they may still try to go after him.

If he was 100% following the advice he was giving publicly *and* he was not trading ahead of his own social media posts he can make the claim that he was making statements of opinion that he was himself acting on. That is his best-case scenario. He'll still eat some fines and probably a temporary ban from the industry and maybe a ban on stock trading/posting about stocks online.

If that *isnt'* what he was doing, he is in a world of hurt.

Did he even give any advice in the last couple of months? I think he was very careful to just post his position.If he was 100% following the advice he was giving publicly *and* he was not trading ahead of his own social media posts he can make the claim that he was making statements of opinion that he was himself acting on. That is his best-case scenario. He'll still eat some fines and probably a temporary ban from the industry and maybe a ban on stock trading/posting about stocks online.

If that *isnt'* what he was doing, he is in a world of hurt.

I know people want to find someone to blame, but the problem is the actor who's really to blame was an 8 milllion strong mob.

Whatever slap on the wrist the SEC gives him will be pennies compared to what he banked on this deal.

It is sad what it came down to. The reasoning was sound enough. Who didn't want to take a crack at making money and hurting the people on Wallsteet that have been fucking over the common man for decades. I guess hopes and dreams do die.

This is what a pump and dump is. Even if someone goes in intending to hold and see where it all goes they're probably going to dump at some point when they see they've made a good amount of money. There was no other ending to this, and I'm sorry the narrative roped you in. All that "diamond hands" stuff was always people making money off someone else.

The Koss family says thank you:

Koss family and company's execs cash in $44 million in stock during short squeeze frenzy

Course they benefited from some very lucky timing:

Koss family and company's execs cash in $44 million in stock during short squeeze frenzy

Course they benefited from some very lucky timing:

The share price increase also came at an opportune time for the insiders who wanted to sell, according to Silverman. The company reported earnings on Jan. 28 and filed its 10Q the following day, allowing the insiders to sell on Monday during their post-earnings trading window.

people hate wallstreet but love the richest man in the world somehow

The guy who has turned himself in a brand and basically pumps his own stock just like this GME thing, detached from much of what his actual company is doing. He's a fucking shill, I don't understand the allure at all.

Yeah, thats a good point. The only issue is that eToro's minimum purchase is $50,. If i cash out my current stocks now, i might get around $20 from my initial investment at $100, and i need to add another $30 if i want to buy in again. If the stock goes up again, i will also gain more since i've invested more (the $30 extra) of course, but if the stock goes down again then, i will end up losing more.Well if you assume it'll continue to go down but still like the stock (there's some arguable reasons), you could sell now and buy back in for more shares. And not entirely sure on this, but I think doing so would also let you claim losses for tax purposes. If you just keep it in there it's just isolated from that afaik, i.e. you don't have realized gains/losses until you sell the stock.

I could also just cash out now, accept the loss and "forget about it", then start fresh again (so to speak) at a later point in time if i want to bet on GameStop again. But i also kinda want to wait and see what happens during the next month or so. I dont have any high hopes though. I talked early about learning about having an exit strategy, but its not always so easy after all :) I was initially going to let the stocks/investment just lie there for quite some time, but i'm also a bit unusure if i should just cash in now and maybe lose ~$80 instead for ~$90. But i will see what i'll end up doing.

About the taxes as you mention, yeah thats true. Where i live, i think theres 30% on taxes. So you have to pay 30% from the profit, and you get 30% back from what you've lost. If i buy in again, i think that will count as a brand new investment, but i cant say for sure.

The cool thing about this is that it taught me about stocks, and I've decided to finally start trading for the first time in my life. Didn't get GME and I've only put in 500 bucks so far, which I can definitely afford to lose, and bought some canadian stocks on Wealthsimple. Did some research to find a couple stocks I actually like, and think have potential (Drone delivery! Something I actually believe in, and a point of sale service that could compete with Shopify). Looking forward to continue building a portfolio over time. Instead of getting takeout at random, I'll put small amounts of money into the account here and there, and invest :)

Im the same. This is what motivated me to finally take an interest and start investing for real. I was so intrigued I ended up watching The Wolf of Wall Street (a 3 hour movie!?) and plan to watch The Big Short as well lol.The cool thing about this is that it taught me about stocks, and I've decided to finally start trading for the first time in my life. Didn't get GME and I've only put in 500 bucks so far, which I can definitely afford to lose, and bought some canadian stocks on Wealthsimple. Did some research to find a couple stocks I actually like, and think have potential (Drone delivery! Something I actually believe in, and a point of sale service that could compete with Shopify). Looking forward to continue building a portfolio over time. Instead of getting takeout at random, I'll put small amounts of money into the account here and there, and invest :)

The Big Short is such a great movie. I watch it every year.Im the same. This is what motivated me to finally take an interest and start investing for real. I was so intrigued I ended up watching The Wolf of Wall Street (a 3 hour movie!?) and plan to watch The Big Short as well lol.

Both fantastic movies! I'm due to rewatch both with the new context, lolIm the same. This is what motivated me to finally take an interest and start investing for real. I was so intrigued I ended up watching The Wolf of Wall Street (a 3 hour movie!?) and plan to watch The Big Short as well lol.

Im the same. This is what motivated me to finally take an interest and start investing for real. I was so intrigued I ended up watching The Wolf of Wall Street (a 3 hour movie!?) and plan to watch The Big Short as well lol.

Margin Call is the best financial drama. Watched it again this week and still totally loved it.

I wonder if he recommended any of these ETF's to his work clients. 62 ETF's include GME.If he was 100% following the advice he was giving publicly *and* he was not trading ahead of his own social media posts he can make the claim that he was making statements of opinion that he was himself acting on. That is his best-case scenario. He'll still eat some fines and probably a temporary ban from the industry and maybe a ban on stock trading/posting about stocks online.

If that *isnt'* what he was doing, he is in a world of hurt.

It's a pretty cool world, and I myself am new to the actual investing part of it. I've followed financials for awhile thanks to my brother being in mining (tons of talk about it when family gathers), but never actually put my foot into the stock water.The cool thing about this is that it taught me about stocks, and I've decided to finally start trading for the first time in my life. Didn't get GME and I've only put in 500 bucks so far, which I can definitely afford to lose, and bought some canadian stocks on Wealthsimple. Did some research to find a couple stocks I actually like, and think have potential (Drone delivery! Something I actually believe in, and a point of sale service that could compete with Shopify). Looking forward to continue building a portfolio over time. Instead of getting takeout at random, I'll put small amounts of money into the account here and there, and invest :)

Key thing is exactly what you said: small, comfortable amounts that you are okay in losing if luck isn't with you. I have to place minimum $500 purchases due to bank, but I ensure that it isn't going to hurt me come the next day if I suddenly can't afford anything. I will admit that I so far have lost on AMC, but I personally believe there will be a resurgent in stocks for entertainment companies reliant on social atmosphere due to vaccines appearing now. Will it happen? Who knows, but that's all part of the wait.

Good to know! I'll watch it this weekend.

I planned to watch WoWS as background noise while I worked, but I was too captivated and ended up giving it my full attention. It was too ridiculous to ignore.Both fantastic movies! I'm due to rewatch both with the new context, lol

Added to my list! Thanks for the recommendation.Margin Call is the best financial drama. Watched it again this week and still totally loved it.

Was gonna post earlier. Best 3 movies to watch after this event would be Big short, wolf of wall street and Margin Call.

so looks like robin hood lifted the restriction, i wonder if some people on reddit will start buying again.

Whoever mentioned Churchill Capital earlier, thanks. Nothing but green for the last few days.

Glad I stayed away from the meme stocks. Never trusted them. CCIV also seems like a bit of a gamble so I'm going to sit that one out I think.

Now the gme/AMC/BB stuff is over, I'm actually looking closely at BB for an investment, aswell as IDEX and PLUG. Any thoughts?

Now the gme/AMC/BB stuff is over, I'm actually looking closely at BB for an investment, aswell as IDEX and PLUG. Any thoughts?

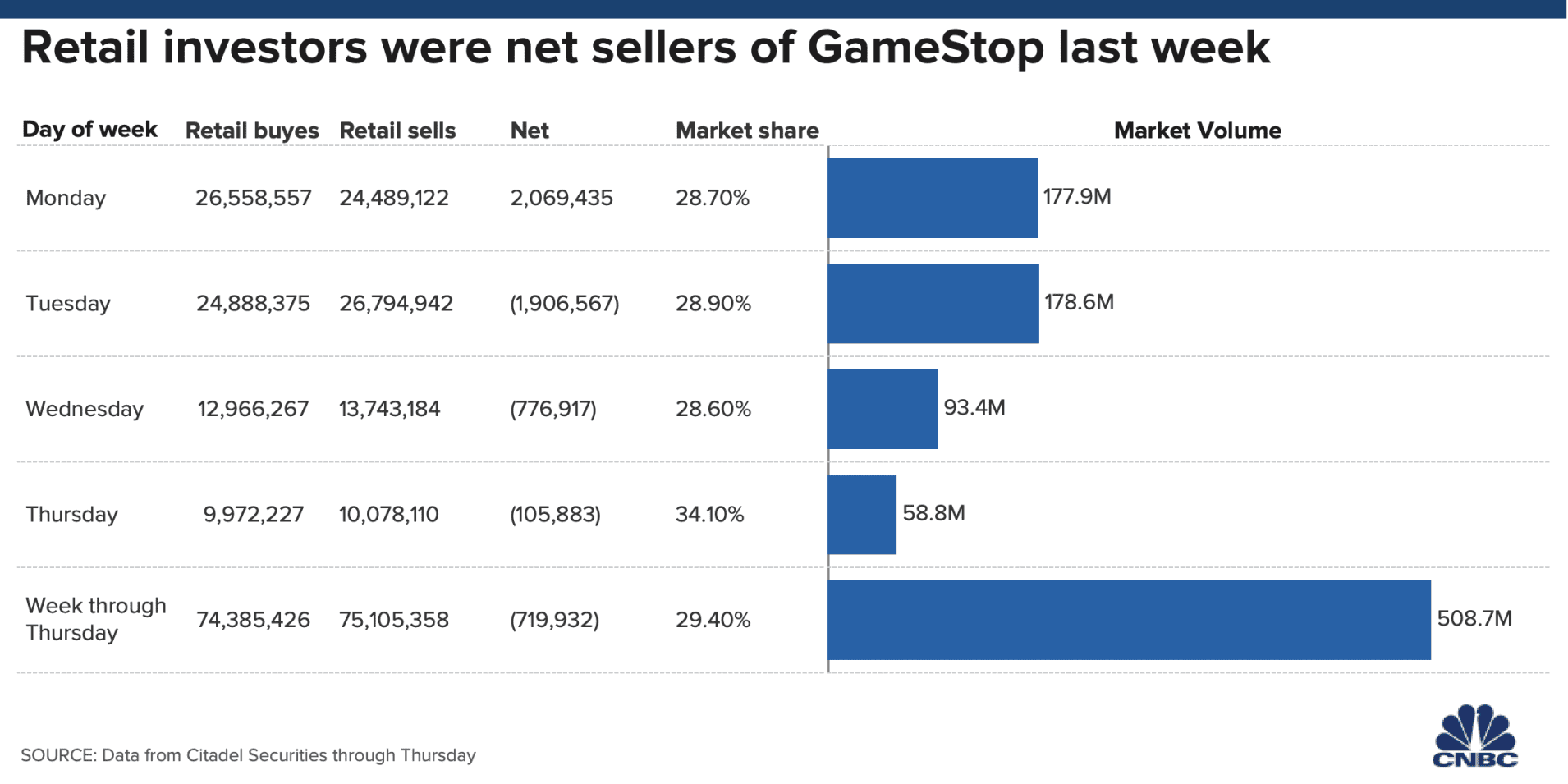

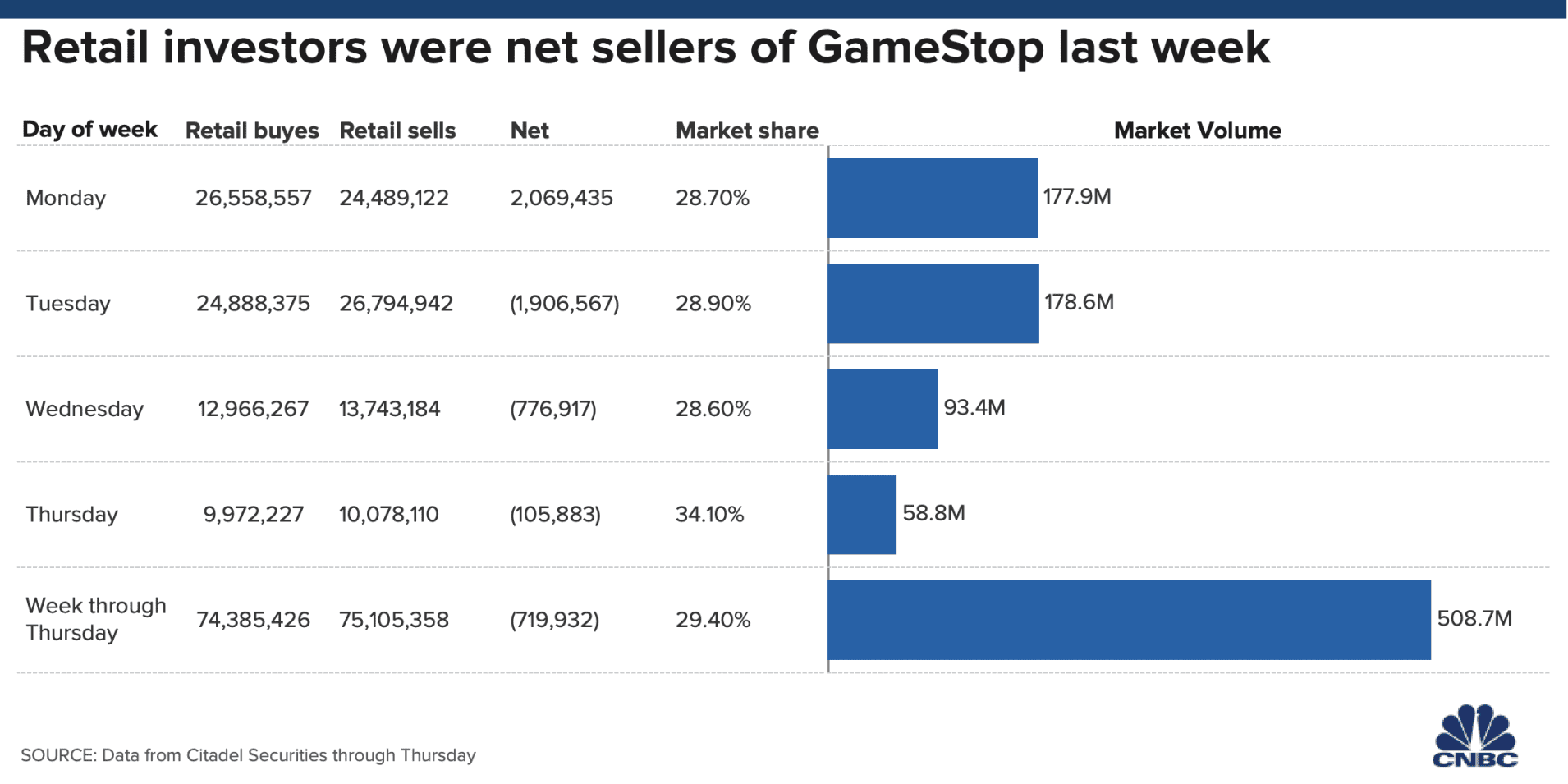

https://www.cnbc.com/2021/02/05/gam...ellion-it-was-perceived-to-be-data-shows.html and to the surprise of no one who understands the stock market

Dead cat bounce.

Shorts at 250+ got out at $50.

Don't throw money at this.

FYI, retail through RH were net sellers of GME last week.

Shorts at 250+ got out at $50.

Don't throw money at this.

FYI, retail through RH were net sellers of GME last week.

Dead cat bounce.

Shorts at 250+ got out at $50.

Don't throw money at this

Yeah that volume caught me off guard. Short covering for sure. Risky shorting a meme stock into the weekend.

But it's not cheap. It was $7 before covid and streaming ravaged the business, and then they diluted shares by nearly three times, which means they'd have to overcome those threats to their business *and* almost triple their previous earnings, to justify the same $7 now. An analyst earlier this week had a $1 PT.I keep buying amc stock as it's so cheap, but logically I know it doesn't make sense as theaters were going down before the virus.

The analyst commented, " We are downgrading our rating for AMC to Sell from Neutral. In our view, the recent volatility and spike in the company's stock, thanks to the Reddit/WallStreetBets crowd, has decoupled AMC's share price and its valuation. Near-term prospects of bankruptcy have been avoided thanks to $1.2bn of fresh capital being raised since mid-December. However, equity shareholders have been diluted by roughly 75% over the last couple months and there is still approximately $5.7bn of debt, a total which is growing each quarter due to deferred interest payments which are tacked on to the principal balance. There is also the overhang of $450mn of deferred rents which will some day need to be addressed. Based on our adjustments made for the recent liquidity events and our reduced box office estimates for 4Q20 and 2021, our price target is now $1 (based on 8.5x our 2022E adjusted EBITDA forecast) down from our prior $2 fair value estimate. At AMC's current share price of $14, EV/adjusted EBITDA is 17x our 2022E projections, almost double the industry's historical peak 9x multiple. The emotion behind the #SaveAMC movement could carry the shares higher in the near-term, but we believe this valuation-be-damned momentum is not sustainable over the long term."

I was first set to keep my remaining investment for a longer period of time and just ride it out, but after yesterday's reply from Ex Lion Tamer and japtor to my comment then, i thought more about it if i would keep the remaining investment or not. Seeing that the GameStop stock price went a bit up today, i decided to sell after all. The price was hovering at around $72, so i set a "take profit" at $75 and a "stop loss" at $70. Either it would sell automatically when it reached about $75, or automatically sell if the price dropped to about $70.

The stock price dropped, and my remaining investment closed at $69.9, giving it a loss at $79.4. I did sell some GameStop positions with profit last week though, and my overall loss ended at $15.22 to be exact. I would prefer to end up with a profit of course, but i dont think it was too bad considering the bigger loss at $79.4 at the end there.

I mostly did it for fun, seeing if i could get a profit or not. I didnt bet that much money to begin with, relatively speaking (maybe i had $150 - $200 invested in GameStop at the most, at the same time). Again, i would prefer to have ended with a profit, but it was an interesting experience at least :) I'm pretty new to the stock market.

Yesterday, i said that i wasnt sure if i would invest more into GameStop, but i will continue to keep an eye on the GameStop stock at least and see how things turn out. If it drops down to the level where it was before this big stock price increase started, maybe i will put a small amount in again, and then rather bet on that GameStop might have some good earning result due to their restructing. Maybe i can make back my loss at $15.22 over time, hehe. But i will see what i decide to do =)

The stock price dropped, and my remaining investment closed at $69.9, giving it a loss at $79.4. I did sell some GameStop positions with profit last week though, and my overall loss ended at $15.22 to be exact. I would prefer to end up with a profit of course, but i dont think it was too bad considering the bigger loss at $79.4 at the end there.

I mostly did it for fun, seeing if i could get a profit or not. I didnt bet that much money to begin with, relatively speaking (maybe i had $150 - $200 invested in GameStop at the most, at the same time). Again, i would prefer to have ended with a profit, but it was an interesting experience at least :) I'm pretty new to the stock market.

Yesterday, i said that i wasnt sure if i would invest more into GameStop, but i will continue to keep an eye on the GameStop stock at least and see how things turn out. If it drops down to the level where it was before this big stock price increase started, maybe i will put a small amount in again, and then rather bet on that GameStop might have some good earning result due to their restructing. Maybe i can make back my loss at $15.22 over time, hehe. But i will see what i decide to do =)

why only look at gamestop?Yesterday, i said that i wasnt sure if i would invest more into GameStop, but i will continue to keep an eye on the GameStop stock at least and see how things turn out. If it drops down to the level where it was before this big stock price increase started, maybe i will put a small amount in again, and then rather bet on that GameStop might have some good earning result due to their restructing. Maybe i can make back my loss at $15.22 over time, hehe. But i will see what i decide to do =)

why not try a longer term, safer stock?

Investing in GME at this point feels like trying to get your high school band back together again when everyone has kids and works 50 hours/week selling car insurance.

I don't know, I was just answering the post before.

Oh, sure. Sorry for not being more clear on that. I just mean in relation to GameStop itself, if i'm going to buy GameStop stocks in the future again or if will skip GameStop, even when the stocks stabilize in price. I'm always open to check out other companies as well :)why only look at gamestop?

why not try a longer term, safer stock?

Yeah, i've been thinking a bit about if i should try to bet on a more long term and safe stock, as you mention. I'm pretty new to the whole stock market, and so far i've mostly done short term trades just to see how that feels like. I'm not exactly sure how long i will do this because it can be a bit stressful to watch the prices very often. So maybe i'll try to bet on some stocks and keep them for a longer time, seeing how things will turn out in the long rund, indeed. I just wish i knew which one(s), hehe. It feels that so many stocks are at the highest price now.

Last edited:

GameStop Stock Plummets: Earnings Won't Turn Things Around

GameStop may have returned to comparable sales growth last quarter, but its earnings probably declined again.

In conjunction with GameStop's Q3 earnings report, management predicted that sales and profitability would return to growth in the fourth quarter. However, that was before sales trends slowed abruptly in December. Right now, the analyst consensus still calls for adjusted earnings per share to reach $1.35, up from $1.27 a year ago. That doesn't seem realistic, though.

An uncertain future

As the pandemic fades and console supply grows, GameStop's sales and earnings trends should improve. That's not saying much, though. The company posted an adjusted operating loss of $267 million for the first nine months of fiscal 2020. Even the most bullish analyst on Wall Street projects that GameStop will earn less than $1 per share this year and $1.57 per share in fiscal 2022.

Even after last week's plunge, GameStop stock trades for more than 40 times this "bullish" estimate for fiscal 2022. That represents a premium to the market and a huge premium to other retail turnaround prospects. (For example, Kohl's stock trades for less than 11 times the most bullish analyst estimate for fiscal 2022.)

This doesn't make much sense. Physical disc sales for console games -- the linchpin of GameStop's business -- continue to lose share to digital downloads. The combination of weak long-term prospects and a high valuation makes GameStop stock likely to fall further in the months and years ahead.

Full article:

www.fool.com

www.fool.com

GameStop may have returned to comparable sales growth last quarter, but its earnings probably declined again.

In conjunction with GameStop's Q3 earnings report, management predicted that sales and profitability would return to growth in the fourth quarter. However, that was before sales trends slowed abruptly in December. Right now, the analyst consensus still calls for adjusted earnings per share to reach $1.35, up from $1.27 a year ago. That doesn't seem realistic, though.

An uncertain future

As the pandemic fades and console supply grows, GameStop's sales and earnings trends should improve. That's not saying much, though. The company posted an adjusted operating loss of $267 million for the first nine months of fiscal 2020. Even the most bullish analyst on Wall Street projects that GameStop will earn less than $1 per share this year and $1.57 per share in fiscal 2022.

Even after last week's plunge, GameStop stock trades for more than 40 times this "bullish" estimate for fiscal 2022. That represents a premium to the market and a huge premium to other retail turnaround prospects. (For example, Kohl's stock trades for less than 11 times the most bullish analyst estimate for fiscal 2022.)

This doesn't make much sense. Physical disc sales for console games -- the linchpin of GameStop's business -- continue to lose share to digital downloads. The combination of weak long-term prospects and a high valuation makes GameStop stock likely to fall further in the months and years ahead.

Full article:

GameStop Stock Plummets: Earnings Won't Turn Things Around | The Motley Fool

GameStop may have returned to comparable sales growth last quarter, but its earnings probably declined again.

Those who continue to parrot this line without -ever- sharing that physical game sales are also continuing to grow are guilty of, at best, harmful ignoranceGameStop Stock Plummets: Earnings Won't Turn Things Around

GameStop may have returned to comparable sales growth last quarter, but its earnings probably declined again.

In conjunction with GameStop's Q3 earnings report, management predicted that sales and profitability would return to growth in the fourth quarter. However, that was before sales trends slowed abruptly in December. Right now, the analyst consensus still calls for adjusted earnings per share to reach $1.35, up from $1.27 a year ago. That doesn't seem realistic, though.

An uncertain future

As the pandemic fades and console supply grows, GameStop's sales and earnings trends should improve. That's not saying much, though. The company posted an adjusted operating loss of $267 million for the first nine months of fiscal 2020. Even the most bullish analyst on Wall Street projects that GameStop will earn less than $1 per share this year and $1.57 per share in fiscal 2022.

Even after last week's plunge, GameStop stock trades for more than 40 times this "bullish" estimate for fiscal 2022. That represents a premium to the market and a huge premium to other retail turnaround prospects. (For example, Kohl's stock trades for less than 11 times the most bullish analyst estimate for fiscal 2022.)

This doesn't make much sense. Physical disc sales for console games -- the linchpin of GameStop's business -- continue to lose share to digital downloads.

The combination of weak long-term prospects and a high valuation makes GameStop stock likely to fall further in the months and years ahead.

Full article:

GameStop Stock Plummets: Earnings Won't Turn Things Around | The Motley Fool

GameStop may have returned to comparable sales growth last quarter, but its earnings probably declined again.www.fool.com

Threadmarks

View all 9 threadmarks

Reader mode

Reader mode