[...]

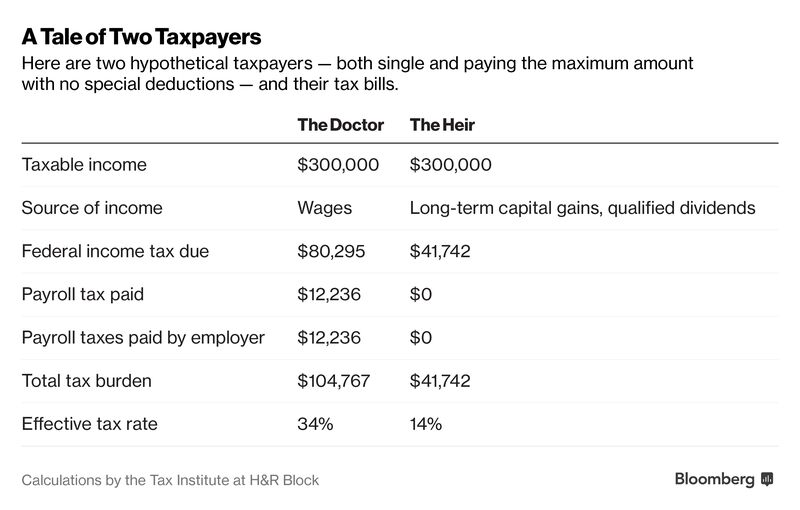

Let's also say we both report $300,000 in income to the Internal Revenue Service this year. Who pays more in taxes?

You do, by a lot. You owe the IRS about $38,500 more, assuming each of us pays the maximum with no special deductions. I also have more flexibility to lower my burden with tax planning strategies and other tricks, and I get to skip about $24,000 in payroll taxes that you and your employer must fork over each year.

This isn't some quirk of the U.S. tax code. Politicians have intentionally set tax rates on wages much higher than those on long-term investment returns. The U.S. has a progressive tax system in the sense that well-paid workers sacrifice much more than poor workers on their "ordinary income." But Americans with so-called unearned income—qualified dividends and long-term capital gains—get a break. A billionaire investor can pay about the same marginal rate as a $40,000-a-year worker, a fact Warren Buffett has famously lamented.

[...]

Americans in the top 1 percent, and especially the top 0.1 percent, have seen their wealth and income multiply in recent decades as the rest of the country's share of the economic pie shrank. Since 2000, a recent study

found, the top 1 percent have made those gains almost entirely on income from capital, especially corporate stock—not on labor income. One reason may be the financial options of the wealthy: Business owners can lower their tax bills by paying themselves in dividends rather than in salary, for example.

[...]