498 babyWasn't that long ago we were celebrating 5200.

Now concerned about dipping below 5k

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Stock Market Era |OT3| Nobody expects the Spanish Inflation!

- Thread starter Sheepinator

- Start date

- OT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Had to Google this, and found that back in January he was asking for a 25% stake in Tesla to prevent getting voted out. Apparently he's at 20.5% now, so whatever.

Yeah, annoying to see it up a lot two days in a row now.

you wanna go full degen? you gotta commitI can't keep buying dips in my brokerage account. Running out of money. Have to save it for big lump into something 👎

-order a 15 month 0% interest credit card

-put all your expenses on that card

-use that money you would've used on food and gas to fund your account

-until you profit, keep paying the minimum on the card, use the money to buy the dip. remember 0 interest for a limited time

-once you profit sell the stocks, withdraw the money and payoff the card, you have 15 months to do this

is there a chance you might become homeless doing this? yes

but can you profit? also yes

Brutal month so far. I tremble to see what we get next week with big tech.

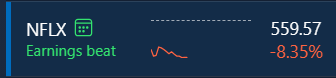

Edit: Wait why are they dropping so big, they beat on earnings with strong sub growth? What more do people want lol

That's really strange that Netflix added 9M subs. All I hear around here is that they're dead, and the password thing was going to destroy them.

Selling at their "peak"? Redistributing those funds for other firesales?Brutal month so far. I tremble to see what we get next week with big tech.

Edit: Wait why are they dropping so big, they beat on earnings with strong sub growth? What more do people want lol

Era bubble™️That's really strange that Netflix added 9M subs. All I hear around here is that they're dead, and the password thing was going to destroy them.

I could probably write a novel about how for the average era user. Netflix peaked in their mind when they were a 20 something doing their 3rd year of college probably a decade ago.That's really strange that Netflix added 9M subs. All I hear around here is that they're dead, and the password thing was going to destroy them.

Anyway Netflix is gonna get crushed because their lowered their Q2 guidance. Oh and for a fun fact for the thread. Next year they won't report quarterly membership numbers or average revenue per member.

Last edited:

That's really strange that Netflix added 9M subs. All I hear around here is that they're dead, and the password thing was going to destroy them.

I could probably write a novel about how for the average era user. Netflix peaked in their mind when they were a 20 something doing their 3rd year of college probably a decade ago.

Many Era users adopt a very US-centric perspective when considering Netflix's business model. This viewpoint overlooks a crucial aspect of Netflix's expansion strategy: the significant growth of its subscriber base in international markets.

Netflix is available in over 190 countries. Most streaming services are simply not available in most markets.

For example, Max is not available in Canada, Australia or the United Kingdom.

In some of these markets, Netflix is the only major streaming service.

Don't even get me started on Era and international streaming markets haha. When Netflix stock tanked because they missed a subscriber growth metric (from dropping Russia due to the war and secretly the money no longer being worth it). I was one of two people that reminded everyone the drop off did not come from America and was so easily explainable Netflix could correct in no time. Because the billions they spent on international programing was working and doing everything it needed to.Many Era users adopt a very US-centric perspective when considering Netflix's business model. This viewpoint overlooks a crucial aspect of Netflix's expansion strategy: the significant growth of its subscriber base in international markets.

Netflix is available in over 190 countries. Most streaming services are simply not available in most markets.

For example, Max is not available in Canada, Australia or the United Kingdom.

In some of these markets, Netflix is the only major streaming service.

Lowered guidance for next quarter by .2 so they are gonna get cookedI don't understand…how is Netflix down 25pts when it crushed the 3.9m sub estimate and added 9.3m??

Earnings are never about current quarter or annual results anymore -- they're about how much you're going to make in the future. Unless a company really misses or really hits.I don't understand…how is Netflix down 25-30pts when it crushed the 3.9m sub estimate and added 9.3m??

There are unconfirmed reports of explosions in the city of Isfahan, Iran, so maybe this could be the reason or at least part of it.Holy moly at the futures down 0.8%. SPX below 5000. Could be a wild day tomorrow.

Ah, that would explain the sudden change. Thanks for the info. Hope it's not trueThere are unconfirmed reports of explosions in the city of Isfahan, Iran, so maybe this could be the reason or at least part of it.

Seems to be true since ABC News just confirmed it. Also, strikes on Syria and Iraq as well.Ah, that would explain the sudden change. Thanks for the info. Hope it's not true

you wanna go full degen? you gotta commit

-order a 15 month 0% interest credit card

-put all your expenses on that card

-use that money you would've used on food and gas to fund your account

-until you profit, keep paying the minimum on the card, use the money to buy the dip. remember 0 interest for a limited time

-once you profit sell the stocks, withdraw the money and payoff the card, you have 15 months to do this

is there a chance you might become homeless doing this? yes

but can you profit? also yes

Best financial advice I've ever seen on this site haha.

I mean who hasn't done this at some point?

cash deploying time tomorrow boys

sell your wife's jewelry

be late on your kids daycare payment

call mom

but buy.the.dip 😤

sell your wife's jewelry

be late on your kids daycare payment

call mom

but buy.the.dip 😤

Buy the dip and cry as it dips even more.

S&P futures just touched -1.65%.

😭

this is the way

Nas futures down 2%, and being Friday I doubt we'll get a good finish.

We won't, not with the Israelis just executing their (seemingly limited) retaliation against Iran.

7%* nowTSM down another 4% after hours... Fuck outta here with that lol...

I recently got some cash that is now sitting in my bank account doing nothing, I was thinking of going all in with the VOO ETF, but I thought about asking here before I did that. Is there something I'm missing or should I just go for it? I just want a safe investment that will sit there for a very long time. I've also heard about QQQM which I also wanted to know more about.

I recently got some cash that is now sitting in my bank account doing nothing, I was thinking of going all in with the VOO ETF, but I thought about asking here before I did that. Is there something I'm missing or should I just go for it? I just want a safe investment that will sit there for a very long time. I've also heard about QQQM which I also wanted to know more about.

You always want to be careful and do research before investing any amount of money, and past performance is not a guarantee of future success.

But, having said that, VOO (or any ETF/Index fund that tracks the S&P 500) is as safe as you can get (compared to other investments). When people say "the stock market, on average, returns 7%-10% per year", they're usually talking about the S&P 500.

Just make sure you won't be needing the cash you're investing anytime soon. When investing you always want to treat it as long term, not short-term. If you have any major expenses you anticipate within the next few years, I'd reconsider investing in the stock market.

Also, if you're unsure about investing, but still want your cash to do something, have you considered opening up a high yield savings account (assuming you don't already have one)?

Since interest rates are so high, a lot of HYS accounts are paying 4.5%-5% APY. Of course you have to have a lot of money in these accounts to see a significant amount of money, but it's way better than what traditional banks are paying.

Keep in mind this is pretty much "traditional" investment advice, and there are other folks in here who have made a nice chunk of change via other investment strategies (which is why you should continue to do research) but in the end do what you feel is best for you, but if you want to play it safe, then yeah VOO is a good way to go.

Last edited:

You always want to be careful and do research before investing any amount of money, and past performance is not a guarantee of future success.

But, having said that, VOO (or any ETF/Index fund that tracks the S&P 500) is as safe as you can get (compared to other investments). When people say "the stock market, on average, returns 7%-10% per year", they're usually talking about the S&P 500.

Just make sure you won't be needing the cash you're investing anytime soon. When investing you always want to treat it as long term, not short-term. If you have any major expenses you anticipate within the next few years, I'd reconsider investing in the stock market.

Also, if you're unsure about investing, but still want your cash to do something, have you considered opening up a high yield savings account (assuming you don't already have one)?

Since interest rates are so high, a lot of HYS accounts are paying 4.5%-5% APY. Of course you have to have a lot of money in these accounts to see a significant amount of money, but it's way better than what traditional banks are paying.

Keep in mind this is pretty much "traditional" investment advice, and there are other folks in here who have made a nice chunk of change via other investment strategies (which is why you should continue to do research) but in the end do what you feel is best for you, but if you want to play it safe, then yeah VOO is a good way to go.

Thanks, I appreciate the advice.

I already have a HYS account with a decent percentage of my savings. I just wanted to see if VOO was a good investment for the rest of it, and yes I'm aware that this is all about playing the long game.

Overly simplistic, but oil ⬆️, gold ⬆️ and I would expect defence stocks like Lockheed, BAE, etc would benefit.

In this specific instance, you need to consider how it would pan out if Iran responds. They would look control the arabian sea and probably also the red sea or at least disrupt trade through it. And I think something like a third of the world's oil travels through the strait of hormuz, so rising oil prices, rising prices in general because of disruption to global trade, rising inflation, etc.

VOO is a fine choice but with the market situation now try to layer it in. Like divide the amount by 6 and put something in every month. Downside risk is real so don't put it in in one go.Thanks, I appreciate the advice.

I already have a HYS account with a decent percentage of my savings. I just wanted to see if VOO was a good investment for the rest of it, and yes I'm aware that this is all about playing the long game.

VOO is a fine choice but with the market situation now try to layer it in. Like divide the amount by 6 and put something in every month. Downside risk is real so don't put it in in one go.

That's a great idea that I had not considered, thanks.

Implied growth is one of the most important stock price driver, so this shouldn't be surprising.Netflix down 40pts at open after those sub #s is ridiculous. Yeah it's based on future projections/guidance but still.

Edit: 50pts now smdh

I recently got some cash that is now sitting in my bank account doing nothing, I was thinking of going all in with the VOO ETF, but I thought about asking here before I did that. Is there something I'm missing or should I just go for it? I just want a safe investment that will sit there for a very long time. I've also heard about QQQM which I also wanted to know more about.

VOO is good, especially if you are young and plan to hold it for a very long time. If you want to be slightly safer, do VTI as its a bit more diversified.